On the same day, PharmAbcine, often referred to as South Korea's first generation biotech venture, saw its corporate value plunge on the stock market on the final day of trading prior to delisting.

|

◇LIVSMED takes flight as overhang concerns dissipate

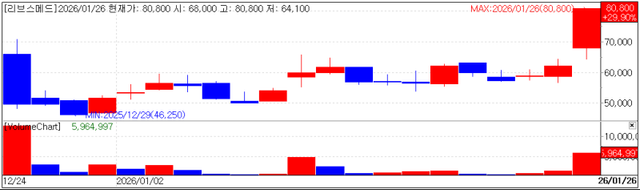

According to KG Zeroin MP Doctor (formerly Market Point), LIVSMED closed at 80,800 won on the day, up 29.90% (18,600 won) from the previous session.

After entering the KOSDAQ market on December 24 at an IPO price of 55,000 won, LIVSMED has risen 46.9% in just one month. The background to its limit up move on the 26th was not only the broader KOSDAQ rally, but also the expiration of the company’s one month lock-up period.

Approximately 10% of LIVSMED’s total shares were subject to lock up release one month after listing. Market observers say that once overhang concerns were cleared following the one-month mark, the stock gained momentum.

A LIVSMED official said, “There is no particular official company announcement that would directly explain the stock price increase. However, as one month has passed since listing, the lock ups of financial investors (FIs) from the pre-IPO period were lifted and last week Stonebridge Ventures’ holdings were transferred stably to global investors through a block deal. This may have been perceived as a positive factor.”

On the same day, news also emerged that the market entry process for innovative medical devices would be significantly accelerated. According to the Ministry of Health and Welfare and the Ministry of Food and Drug Safety, a process that previously took 490 days will be shortened to just 80 days.

Under the new system innovative medical devices that undergo internationally recognized clinical evaluation by the MFDS will be allowed to enter the market immediately without undergoing a separate new medical technology assessment.

A LIVSMED official commented “This could be positive for the industry overall. Since our company already generates revenue from products that have entered the market, we do not expect immediate short-term results. However, if newly launched products such as ArtiSeal, as well as future pipeline products, are designated for the new medical technology evaluation pathway, the positive impact could be significant.”

|

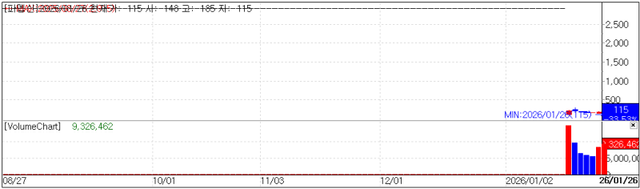

◇PharmAbcine market cap falls to KRW 9.2b on final trading day

Ahead of its delisting from the KOSDAQ market on the 27th, PharmAbcine closed on the 26th down 33.53% (58 won) at 115 won per share, with a market capitalization of 9.2 billion won.

Listed in 2008 and once attracting investments from companies such as Novartis, PharmAbcine had been regarded as a first-generation Korean biotech venture making its delisting particularly meaningful for the domestic biotech industry.

Although PharmAbcine is exiting the public market, it still has pipelines under R&D and held 44.0 billion won in cash and time deposits as of the end of September last year. Delisting does not appear to mark the end of the company.

Last month on the 17th, PharmAbcine reported Phase 1 clinical trial results for PMC-403, a treatment for neovascular age related macular degeneration.

On the 2nd of this month it also highlighted its business progress through the out-licensing of immuno-oncology drug PMC-309 to Aprogen. The contract size was not disclosed, though it is understood to be relatively modest disclosures suggest a minimum value of approximately 7.5 billion won.

On the 15th, PharmAbcine completely reshuffled its board of directors through an extraordinary shareholders’ meeting, signaling an intention to alter its future business strategy.

At the same meeting the company moved its headquarters from Daejeon to Yongin and increased its authorized share count from 100 million to 300 million shares, indicating the possibility of future fundraising.

While CEO Shim Joo yeop holds 14,285,715 shares (17.81%), the Tirebank Group is the largest shareholder. Chairman Kim Jung kyu holds 13,790,009 shares (17.19%), and including related parties, the group controls a combined 45.74% stake.

Specifically, Tirebank, controlled by Chairman Kim, holds 5,607,718 shares (6.99%), while Kim Sung-yeon holds 5,943,087 shares (7.41%), Kim Soo-yeon holds 6,551,930 shares (8.17%), and Kim Seung yeon holds 4,799,810 shares (5.98%).

Yoo Jin-san, Vice President and CTO as well as founder of PharmAbcine said “If PMC-309 is further out licensed by Aprogen, a large amount of milestone payments will flow into PharmAbcine."

He added "PMC-403 has successfully completed Phase 1, so it is also an out-license candidate. In addition a bispecific antibody derived from PMC-403 is currently in early research supported by a 6.5 billion won government grant from the Ministry of Health and Welfare.”

Copyright ⓒ 이데일리 무단 전재 및 재배포 금지