Driven by innovative technology and momentum for global market expansion strong buying interest pushed key bio stocks higher effectively defying the broader market's downward pressure.

◇

|

◇NEUROPHET Hits 52 Week High on Unrivaled Alzheimer’s Diagnostic Prowess

According to KG Zeroin MP DOCTOR, NEUROPHET, BL Pharmtech, and NGeneBio secured spots among the top 10 gainers in the domestic market that day.

Notably NEUROPHET an artificial intelligence (AI) specialist focused on diagnosing and treating brain diseases surged 29.91% to close at won 36,700 marking its second consecutive day at the daily upper price limit. During the session the company also reached a new 52week high maintaining a steep upward trajectory.

The primary catalyst for this surge was the news that the company’s flagship solution, Neurophet AQUA AD Plus, received 510(k) clearance from the U.S. Food and Drug Administration (FDA).

This solution utilizes AI to automatically detect the location and number of brain microbleeds a critical requirement for prescribing Alzheimer’s treatments. With side effect monitoring for treatments like Leqembi becoming a focal point in the industry NEUROPHET’s ability to analyze both treatment efficacy and adverse effects simultaneously has captured the attention of global big pharma.

The outlook remains highly promising. As the Alzheimer’s treatment market expands, the necessity of FDA cleared solutions like AQUA AD Plus is expected to grow. The company anticipates a first mover advantage in Asian markets, including Japan and China, following the regional approval of Leqembi.

Furthermore ongoing research collaborations with giants like Roche could lead to formal commercial contracts, positioning the company to hit its 2027 profitability target and establish itself as a global standard.

“Following FDA approval in the U.S., subsequent approvals in countries like Japan, China and Korea have made Asia a central hub.” said Junkil Been Co CEO of NEUROPHET. “This clearance will be pivotal in securing leadership in the Alzheimer’s treatment market particularly across Asia.”

|

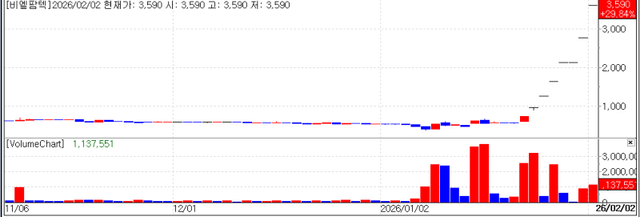

◇BL Pharmtech Corp Surges Fivefold in a Month on Billion-Dollar Licensing Hopes

BL Pharmtech Corp. also soared 29.84% to won 3,590, extending its streak of hitting the daily price limit to seven consecutive trading days. Having traded in the won 500 range at the end of last year, the stock has skyrocketed more than fivefold within a single month, ranking first in growth among all domestic listed companies this year. At the heart of this explosive growth is a "game changing" technology: Molecular Glue.

Molecular Glue is a platform technology that goes beyond merely inhibiting disease causing proteins it forces a "permanent deletion" by linking these harmful proteins with the cell's internal waste disposal system (ubiquitin proteasome system).

BL Pharmtech secured this technology through its subsidiary BL Melanis which was recognized globally last year as a winner of Amgen’s ‘Golden Ticket’ program. Currently BL Pharmtech is reportedly in simultaneous licensing negotiations with three major domestic bio companies, each valued between several trillion and tens of trillion won.

This transition is expected to trigger a significant leap in corporate value. If the ongoing billion dollar licensing deals are finalized, the financial structure and market standing of BL Pharmtech formerly a small-cap stock—will be fundamentally transformed.

Since Molecular Glue applications extend beyond oncology to areas like autoimmune diseases, the Amgen recognition is seen as a starting point for a series of platform alliances and joint development momentum with global big pharma.

“Molecular Glue technology has moved beyond theory and has already proven its anti cancer efficacy in animal models,” stated Park Young chul Chairman of BL Pharmtech. “As global big pharma firms are increasingly engaging in multi-billion dollar deals in this field we are fully committed to delivering tangible results with the right partners.”

|

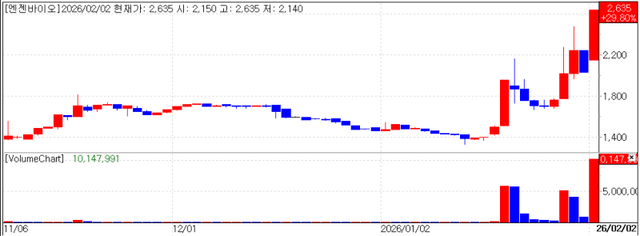

◇NGeneBio Evolves into ‘AI Medical Data Firm’ via Alliances with LG and AMC

NGeneBio also joined the rally, jumping 29.80% to won 2,635. The company recently showcased its "Total NGS Solution" capabilities by signing a large scale long term contract with Gachon University Gil Medical Center to establish a precision diagnostic platform.

This deal involves the integrated supply of high capacity Next Generation Sequencing (NGS) equipment and NGeneBio’s proprietary analysis software, NGAS 2.0.

The market is particularly focused on NGeneBio’s strategic pivot toward becoming an AI-driven medical data company. The firm recently secured an exclusive license for EXAONE Path 2.0, a precision medicine model from LG AI Research.

This technology enables AI-powered analysis of genetic mutations in under a minute a process that typically takes two weeks. Additionally NGeneBio strengthened its data prowess by acquiring the technology for NGLIS a next generation genomic information management system from Asan Medical Center (AMC).

These moves signal a major revaluation of NGeneBio as an AI medical data platform. By securing exclusive technological advantages through collaborations with LG AI Research and AMC the company plans to provide standardized software to over 30 major hospitals globally establishing a stable subscription based revenue model.

Once its multi modal precision diagnostic system is fully operational NGeneBio is expected to settle in as a key player in the digital healthcare sector.

“We are evolving into a platform company that creates new medical value by combining AI with multi modal data, moving beyond simple diagnostic kit sales.” said Minsick Kim CEO of NGeneBio. “By strengthening partnerships with tertiary general hospitals we aim to achieve both substantial revenue growth and technological advancement simultaneously.”

Copyright ⓒ 이데일리 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.