Beyond mere expectations investors flocked to companies that demonstrated "numbers" and "references" such as equity swaps with major conglomerates and the establishment of actual billing models in major hospitals.

The stars of the market on this day were undeniably U2Bio, Pharos iBio and JLK. U2Bio which showed the most significant rise, went straight to the daily limit at the start of trading upon news of a strategic alliance with Daewoong Pharmaceutical spreading warmth throughout the digital healthcare sector.

|

◇U2Bio forms a 'Strategic Alliance' with Daewoong Pharmaceutical... Hits Daily Limit

According to KG Zeroin MP Doctor (formerly MarketPoint) on the 13th, U2Bio soared to the daily price limit of 29.9% compared to the previous trading day, closing at 5,490 won. The direct trigger for the stock price surge was the disclosure of an equity swap with Daewoong Pharmaceutical.

Daewoong Pharmaceutical decided to transfer 564,745 treasury shares (approximately 12.1 billion won) to U2Bio via investment in kind. In return U2Bio issued 2,388,278 new shares through a third party allotment capital increase. Upon completion of the transaction Daewoong Pharmaceutical will hold a 14.99% stake in U2Bio becoming the second-largest shareholder after the current largest shareholder Lee Jae woon founder of Socar (31.56% stake).

The background behind Daewoong Pharmaceutical’s decision to invest in U2Bio is clear. Through a public disclosure Daewoong stated "We selected U2Bio, which operates in vitro diagnostic testing services and medical IT solutions as the optimal strategic investment target to strengthen our digital healthcare business competitiveness.

" This suggests that the domestic pharmaceutical industry is shifting from traditional chemical and biological drug-based businesses to full scale healthcare platforms.

Prior to this investment Daewoong Pharmaceutical exchanged treasury shares worth 13.8 billion won with Kwangdong Pharmaceutical last December. In less than six months, Daewoong has transferred a total of 25.9 billion won worth of treasury shares to Kwangdong Pharmaceutical and U2Bio.

This amounts to approximately 13% of Daewoong's treasury shares, demonstrating a concrete commitment to strengthening its digital healthcare business.

U2Bio recorded 25 billion won in revenue and an operating loss of 3.1 billion won in 2024. This was due to a sharp decline in molecular diagnostic testing revenue as the COVID-19 pandemic special demand faded.

Specifically revenue from molecular diagnostic testing services plummeted from 25 billion won in 2022 to 2.2 billion won in 2024 and sales of molecular diagnostic test reagents also decreased from 22.4 billion won to 100 million won during the same period.

Amidst this crisis, U2Bio is building new growth engines. Revenue from general diagnostic testing services remained relatively stable, rising slightly from 11.1 billion won in 2022 to 11.5 billion won in 2024.

The microbiome business is drawing particular attention. The microbiome market, based on gut health solutions via microbial analysis, is growing rapidly both domestically and internationally. In the third quarter of 2024, the company launched subscription services for 'U2Biome' and 'U2Biome Bebe' aiming to build a stable profit generation structure.

Interestingly, U2Bio founder and CEO Kim Jin tae is listed as a specially related person to former CEO Lee Jae woong and will not step down from the management frontline. Even with the change in the largest shareholder the structure ensures that CEO Kim remains in charge of practical management.

This move is interpreted as an intention to minimize confusion caused by the change in management rights and ensure business continuity signaling management stability to investors.

|

◇Tangible Clinical Results for AI Drug Development Platforms...Global Expectations Rise

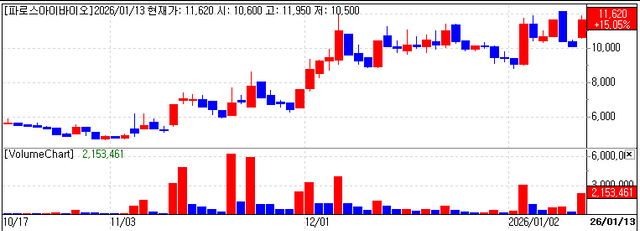

Pharos iBio closed at 11,540 won on the 13th, up 14% from the previous day. This rise is analyzed to reflect the overall positive evaluation of the AI-based drug development industry.

In particular as expectations for global AI drug development companies continue following the successful Hong Kong listing of China's Insilico Medicine, Pharos iBio, a leading domestic company, also benefited.

Pharos iBio’s main pipeline consists of two anticancer drugs being developed based on its AI drug development platform, 'Chemiverse.'

First, the acute myeloid leukemia (AML) treatment 'PHI-101 (Lasmotinib)' is the most advanced pipeline. Lasmotinib officially received its International Nonproprietary Name (INN) from the World Health Organization (WHO) last November. Safety and efficacy were confirmed in a global Phase 1 clinical trial for patients with relapsed or refractory AML with FLT3 mutations, and it is currently preparing to enter Phase 2.

It has already been designated as an orphan drug by the MFDS (2024) US FDA and European EMA and is also undergoing a domestic Phase 1 trial for recurrent ovarian cancer indications.

The refractory solid tumor treatment 'PHI-501' is garnering significant market expectation despite being in the early clinical stages. This candidate substance, which recently successfully completed an investigator meeting, has a mechanism that dual inhibits pan RAF and DDR1 (Discoidin Domain Receptor 1).

While existing approved drugs caused tumor promotion issues in BRAF wild-type tumors, PHI-501 was confirmed to overcome this in preclinical trials. Global pharmaceutical companies are paying attention to this innovative mechanism and discussions on technology transfer are underway.

Kim Gyu tae, CEO of Pharos iBio Australia, stated, "We have been selected as a presenting company as the EW Biopharma Summit is held in Seoul for the first time. Based on our R&D achievements we will discuss wide ranging possibilities for research and business collaboration with global stakeholders."

|

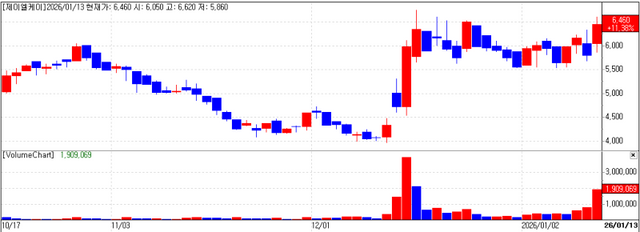

◇JLK Signals Commercialization of Medical AI with Adoption by Asan Medical Center

JLK closed at 6,460 won on the 13th, up 11% from the previous day. This rise is analyzed as a positive evaluation following the company's disclosure on the same day regarding the adoption of its stroke AI solution by Asan Medical Center.

Actual clinical adoption by Korea's largest tertiary general hospital, with approximately 2,700 beds, is accepted as a signal that medical AI is entering the commercialization stage.

JLK's stroke image analysis AI solution, 'JBS-01K (JLK-DWI),' analyzes MRI-based Diffusion Weighted Imaging (DWI) to classify the cause of cerebral infarction.

The AI detects suspected infarction lesions, analyzes the size, location and pattern of the lesions and presents probabilities for three types according to the TOAST classification: Large Vessel Disease (LVD), Cardioembolism (CE), and Small Vessel Disease (SVD).

Seoul Asan Medical Center introduced stroke AI solutions, including JBS-01K, as a subscription model in an environment where large-scale patient and vast imaging data must be processed simultaneously.

In an environment where hundreds of CT and MRI scans must be read daily, delays in image reading lead directly to delays in treatment for emergency patients, making speed and consistency paramount.

Earnings estimates from the securities industry are also positive. A researcher at Korea Investment & Securities expects JLK's revenue to reach approximately 10.8 billion won in 2026. Considering that annual costs are in the 12 to 13 billion won range, the scenario suggests that a meaningful turnaround to operating profit is possible by 2027.

Korea Investment & Securities analyzed "High growth will continue as domestic market share expansion, insurance fee issuance and commercial entry into Japan and the US coincide." adding "A meaningful turnaround to surplus is expected in 2027."

Kim Dong min CEO of JLK also stated "Based on the case of Seoul Asan Medical Center we will accelerate supply to large hospitals."

Copyright ⓒ 이데일리 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.