Buying power was particularly concentrated on companies securing first or exclusive positions in fields such as 3D printing based shape memory materials multi joint surgical instruments, and surgical robots. We analyzed the causes of the stock price rise and future prospects of Graphy, Livsmed and WSI which led the market today.

|

◇Graphy, "K-Clear Aligners sought after overseas first"... Up 18%

According to KG Zeroin MP Doctor (formerly Market Point) on the day Graphy closed at 32,200 won up 18% from the previous trading day, attracting the hottest attention. Although the stock fluctuated due to overhang (potential selling volume) concerns following its listing on the KOSDAQ last August, it has recently switched to a strong upward trend attempting to settle in the 30,000 won range.

It is encouraging that institutional investors have been net buying for five consecutive trading days. It is interpreted that after the Venture Capital (VC) volume which sought profit taking in the early stages of listing was digested to some extent new entries from pension funds and investment trusts expecting earnings growth are driving the stock price rise.

The background of the surge is analyzed to be the expectation of global market expansion for its independently developed Shape Memory Aligner (SMA). Graphy’s SMA utilizes a material that restores its shape in reaction to body heat characterized by providing continuous orthodontic force while adhering softly to teeth.

In particular the fact that "chair time" (treatment time) can be reduced by 30 to 60 minutes compared to existing clear aligners, and the expansion of the "order made model" where devices are manufactured and delivered simply by sending oral scan files from dental clinics are expected to contribute significantly to profitability improvement.

The industry expects sales growth to become steeper next year and believes these expectations for an earnings turnaround are pre reflected in the stock price.

Sim Woon seop CEO of Graphy said "We implemented 'Light Force,' an ideal force that induces cell tissue changes, to reduce pain and increase orthodontic efficacy."

adding "Partnerships with Bondent in China are materializing, and inquiries from global companies in the US and Europe are continuing."

|

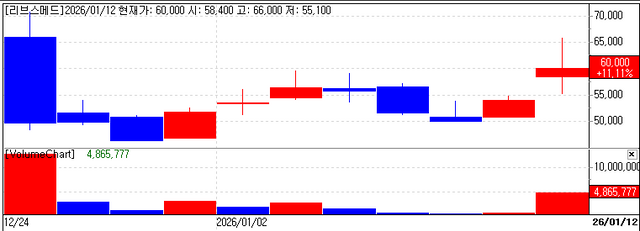

◇Livsmed, Starts 'Technology Monopoly' with Acquisition of US FlexDex Assets... 11% Strength

Livsmed recorded 60,000 won, up 11% from the previous trading day. After a significant drop following its listing, it was trapped in a box range of 40,000 to 50,000 won however, this "technology monopoly" issue acted as a catalyst allowing it to break through the strong resistance line of 55,000 won in one breath.

Trading volume also exploded by more than 500% compared to the previous day indicating active turnover. In particular the buying spree from foreign investors is notable.

The news that it established a global patent barrier by acquiring the technology assets of "FlexDex Surgical" a US surgical instrument specialist acted as a positive factor. Through this acquisition Livsmed secured a total of 939 intellectual property rights receiving evaluations that it has virtually completed a "technology monopoly system" in the multi joint surgical instrument field.

The company’s main product is a multi joint laparoscopic surgical instrument applied with up down left right 90 degree rotation and 360 degree multi degree of freedom Pin Joint technology.

Lee Jung joo CEO of Livsmed emphasized "We have built a multi layered patent fence that competitors cannot covet." predicting the expansion of a full spectrum lineup including the surgical robot "Stark" The securities industry predicts that this IP acquisition will play a role as a strong "Moat" in competition with global major medical device companies in the future.

|

◇WSI, From Distribution to 'Manufacturing'... 10% Up on Robot & Obesity Drug Momentum

WSI also finished trading at 4180 won, up 10.4% from the previous trading day. It is interpreted that investor sentiment was stimulated by the company advancing its business structure from existing pharmaceutical and medical device distribution to in house development and manufacturing while presenting a goal of "100 billion won in sales by 2028."

Although it underwent a long price adjustment due to worsening sentiment in the bio sector over the past year it created a long bullish candle on the 12th and strongly broke through the 120 day moving average. Securities firms view the explosion of massive volume at the bottom as a signal of a trend reversal.

The core of the upward momentum is the new businesses of its subsidiaries. The obstetrics and gynecology surgical assist robot "U-BOT" developed by subsidiary EasyMedibot is awaiting product approval from the Ministry of Food and Drug Safety in the first half of this year.

U-BOT is drawing attention as an efficient solution to replace medical staff amidst market environments such as the shortage of OB/GYN doctors and increasing demand for robot surgery.

Another subsidiary, IntroBiopharma, is developing a "GLP-1 oral obesity treatment," a recent hot keyword. The market atmosphere highly evaluates the powerful new growth engines of robots and obesity treatments added on top of the stable cash cow of the main business.

Lee Yun seok CEO of WSI expressed his ambition stating "Next year will be the first year of full-scale growth" and "We will achieve vertical integration of distribution and manufacturing through synergies with subsidiaries."

Copyright ⓒ 이데일리 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.