Cellumed which had once been designated as an administrative issue stock after receiving a disclaimer of audit opinion has continued a sharp rally for four consecutive days since welcoming a new largest shareholder.

Onconic Therapeutics benefited from rising expectations on top of stable revenue growth based on its P-CAB drug business while DXVX saw investor sentiment strengthen after its largest individual shareholder disclosed participation in a 100 billion won capital increase.

|

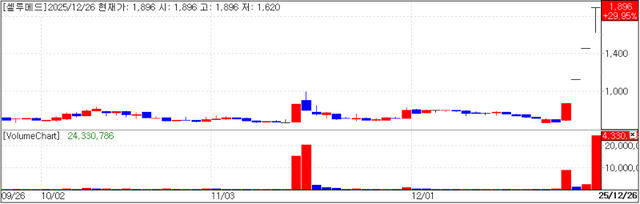

◇Cellumed Stock Price 670→1896 won

According to KG Zeroin MP Doctor (formerly Market Point) Cellumed’s share price closed at won 1,896 on the day up 29.95% (won 437) from the previous session.

Cellumed a biomedical device company, had previously been designated as an administrative issue stock and faced trading suspension after its semiannual report received a disclaimer of audit opinion. However it has recently regained investor attention following a change in its largest shareholder during a capital increase.

As of the half-year mark Cellumed recorded a capital impairment ratio of 70% and incurred won 16.9 billion in liabilities after losing a royalty lawsuit related to an artificial joint business with U.S. based Buechel. With cash and cash equivalents of only about won 2.3 billion as of the end of the third quarter securing funding was essential for the company’s continued operations.

Stepping in as a rescuer for the troubled Cellumed was L&C Bio. L&C Bio’s 67.14% owned subsidiary L&C ES as well as the Global Medical Research Institute 45.4% owned by L&C Bio participated in Cellumed’s capital increase providing the necessary funding. Investors are now placing expectations on Cellumed’s potential turnaround through business synergies with L&C Bio.

This capital increase totaled won 17 billion at an issue price of won 603 per share, with participation from L&C ES, Now IB Capital and the Global Medical Research Center. Now IB Capital is a financial investor (FI) in L&C Bio, suggesting its participation was related to that connection.

Specifically L&C ES invested won 9 billion to acquire 14,925,373 share becoming Cellumed’s new largest shareholder. Now IB Capital invested won 5 billion to acquire 8,291,873 shares, while the Global Medical Research Center invested won 3 billion to acquire 4,975,124 shares.

Cellumed’s share price has already risen to more than three times the won 603 issue price paid by these investors. The new shares are scheduled to be listed on January 20 and the new shareholders are subject to a one year lock up period.

|

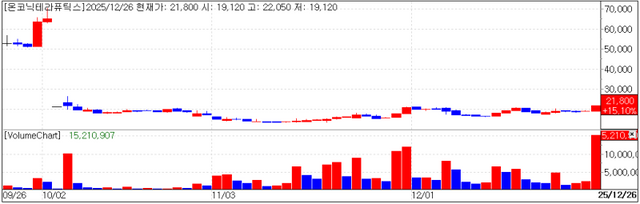

◇Onconic Therapeutics: Smooth Sailing for “Jaqbo,” Plus Expectations for Phase 1 Data on “Nesuparib”

According to KG Zeroin MP Doctor, Onconic Therapeutics closed at won 21,800 up 15.1% (won 2,860) from the previous session.

This movement is closely linked to the company’s recent upward revision of its annual revenue and operating profit forecasts. Sales of “Jaqbo” tablets and technology transfer (milestone) income exceeded expectations.

Onconic Therapeutics revised its annual revenue forecast from won 24.9 billion to won 53.5 billion and its operating result from an expected loss of won 5.4 billion to an operating profit of won 11.5 billion.

The company explained that the revised figures were based on internal forecasts reflecting cumulative third quarter performance and both internal and external business conditions.

In fact, sales of Jaquebo, a potassium-competitive acid blocker (P-CAB) increased sequentially from won 7.0 billion in Q1 to won 9.4 billion in Q2 and won 12.3 billion in Q3, reaching cumulative sales of won 28.7 billion as of the end of Q3.

With Jaquebo generating stable revenue, Onconic Therapeutics is also advancing the future value of the company through Phase 2 clinical trials of its anticancer drug Nesuparib.

Lee Dal-mi, an analyst at SangSangin Securities, forecast Q4 revenue of won 16.2 billion an 83.3% year on year increase based solely on Jaquebo sales without milestone income and operating profit of won 2.5 billion up 82.9% year on year.

She also noted that expectations remain valid ahead of the release of clinical results for Nesuparib a PARP inhibitor anticancer drug scheduled for the first half of next year.

Nesuparib has begun dosing its first patient in a domestic Phase 2 trial for pancreatic cancer. A Phase 2 combination trial for ovarian cancer with Celltrion’s Vegzelma is scheduled to begin in the first half of next year and a Phase 2 trial for gastric cancer is also planned.

Additionally, Onconic Therapeutics will participate in the JP Morgan Healthcare Conference in January next year and plans to present Phase 1 results for Nesuparib at the AACR conference in April and ASCO in June. Positive outcomes could lead to further upside in the share price.

|

◇DXVX gains on back of Lim Jong-yoon’s won 100 Billion Capital Increase Participation

According to KG Zeroin MP Doctor, DXVX closed at won 2,875, up 10.79% (won 280) from the previous session.

DXVX has gained momentum since announcing a third-party allotment capital increase of approximately won 100 billion, targeting its largest shareholder and chairman, Lim Jong-yoon.

Market sentiment reflects the view that “if an individual largest shareholder is investing won 100 billion, he must be planning to do something substantial.”

In fact, DXVX is the first case in which a single largest shareholder has participated in a capital increase of this magnitude. While capital increases targeting controlling shareholders are often conducted at a discount, DXVX’s offering was priced at won 2,027 per share a 20% premium to the reference share price of won 1,688.

The funds are intended for working capital and facility investments among other purposes. The newly issued shares will be subject to a one year lock up period.

The payment date for the capital increase is the 30th of this month, and whether the funds will actually be paid in remains a key point of interest. No concrete details have been disclosed regarding how Chairman Lim plans to secure the won 100 billion.

However, attention is focused on the possibility that he may leverage his holdings in Hanmi Science. Chairman Lim personally holds 1.05% of Hanmi Science shares, while his wife Hong Ji yoon holds 0.83%, and his children hold stakes of 1.02% (Lim Seong yeon), 1.08% (Lim Seong ji), and 1.08% (Lim Seong a).

The combined Hanmi Science stake held by Chairman Lim’s family amounts to 5.06%, of which 3.57% is reportedly not pledged as collateral representing a market value of approximately won 90 billion.

A DXVX official stated “Through this capital increase, we aim to alleviate market concerns over full capital impairment and secure funding for new growth engines such as R&D.”

adding “Based on improved financial stability, we will begin to deliver tangible new drug development outcomes next year, including potential global licensing out deals to enhance shareholder value.”

Copyright ⓒ 이데일리 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.