|

◇Rznomics jumps again after “quadruple” IPO debut

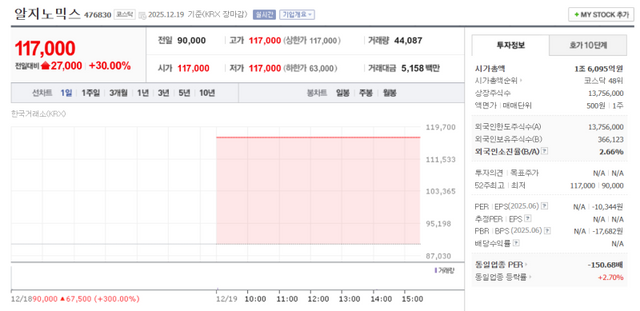

According to KG Zeroin’s MP Doctor (formerly Market Point) Rznomics closed at 117,000 won up 27,000 won (30%) from the previous day maintaining its upper limit level throughout the session.

Rznomics made a spectacular KOSDAQ debut on the 18th recording a so called “quadruple” on its first trading day closing at four times its IPO price. Based on the offering price of 25,000 won the company’s market capitalization jumped from 309.5 billion won to 1.238 trillion won in a single session. As of the 19th its market cap further expanded to 1.6095 trillion won.

Despite the rapid surge, market participants continue to see room for further upside. Comparisons are being drawn with Olix another RNA based therapeutics developer which currently carries a market capitalization of 2.7317 trillion won. Rznomics holds proprietary RNA gene editing core technologies, adding to expectations.

An industry source said “The IPO market for biotech companies appears to be regaining momentum recently. Just look at Aimed Bio Inc., which achieved a ‘quadruple’ on its first trading day and immediately ranked among the top 11 KOSDAQ companies by market cap.”

The source added “Rznomics entered the market at a time when RNA therapeutics were emerging as a key modality and had already delivered a trillion won scale licensing deal with a global pharmaceutical company. Its conservative IPO pricing also likely contributed to the post-listing surge.”

In May Rznomics signed a technology licensing agreement with Eli Lilly worth up to 1.9 trillion won. Several internally developed drug candidates are also reportedly under technical review by multiple global pharmaceutical companies.

Interim clinical results for RZ-001 being developed for glioblastoma and hepatocellular carcinoma, are scheduled to be presented at international conferences later this year and in the first half of next year.

|

◇Genome&Company re-rated as antibody-focused ADC player, jumps over 20%

Shares of Genome&Company surged 1,230 won (20.99%) to close at 7,090 won. The rally was attributed to the release of a previously paywalled Pharm Edaily Premium article that became freely accessible earlier in the morning.

The article, published at 8:22 a.m. under the title “[Head-to-Head K-Bio] Antibody Based ADC Players Genome&Company and Aimed Bio.” highlighted Genome&Company and Aimed Bio Inc. as companies centered on antibody driven ADC strategies.

According to the analysis as key patents related to ADC linkers and payloads have expired or are nearing expiration differentiation within the ADC space is increasingly shifting toward antibody selection.

In this context Genome&Company’s antibody discovery platform GNOCLE is drawing renewed attention. The platform leverages patient-derived data and multi omics datasets in collaboration with major tertiary hospitals in Korea to identify highly suitable antibodies.

Genome&Company is viewed as having partially validated its ADC capabilities through two technology transfer deals a 586 billion-won out-licensing of GENA-111 to Switzerland based Debiopharm in June last year followed by a licensing agreement for immuno oncology asset GENA-104 with UK-based Ellipses Pharma this February.

|

◇HansBiomed tumbles on ‘going-concern uncertainty,’ company says issue largely resolved

HansBiomed Corporation saw its shares plunge as much as 4,750 won (-14.05%) intraday before trimming losses to close at 31,400 won down 2,400 won (-7.1%). The drop followed the submission of its audit report after the previous session’s close.

In the audit report, the external auditor noted that “material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern.”

The assessment cited a 316 billion won net loss current liabilities exceeding current assets by 25.4 billion won and a ratio of continuing operating losses before tax to equity of 87.8%, well above the 50% threshold.

A HansBiomed official explained “The audit was based on financials through the end of September and subsequent fundraising activities were not reflected. As such, the going concern issue has effectively been resolved.”

HansBiomed’s fiscal year runs from October 1 to September 30, differing from most listed companies. After closing its annual accounts the company faced renewed pressure following a first instance court ruling against it in a damages lawsuit related to its silicone breast implant product Bellagel.

The damages amount of 21.5 billion won, finalized last month was reclassified on the 17th from non operating loss to selling and administrative expenses driving last year’s operating loss from 3 billion won to 25.9 billion won.

To shore up liquidity HansBiomed sold 300,000 treasury shares for 9.7 billion won on October 27 and later resolved to sell the remaining 239,388 shares for 8 billion won. On November 2 the board also approved a rights offering of 700,000 common shares raising 18.6 billion won at an issue price of 26,573 won per share.

Proceeds are slated for working capital though some may be used to cover damages depending on appeal outcomes.

“The issues raised are not new and have already been disclosed.” a company representative said “The market appears to be reacting sensitively.”

Copyright ⓒ 이데일리 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.