|

◇‘Record Valuation’ Drug Developer Aimed Bio Joins KOSDAQ

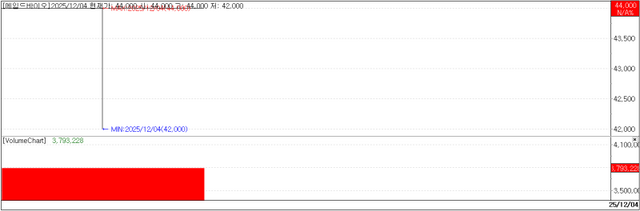

Newly listed KOSDAQ player Aimed Bio closed its debut session at 44,000 won, up 300% (33,000 won) from its offering price.

Aimed Bio had finalized its IPO price at the top end of the hoped-for band of 9,000–11,000 won, listing with a valuation in the 700 billion won range. That was viewed as the highest valuation assigned to a new drug developer listing on KOSDAQ over the past five years.

Even with its lofty valuation, the IPO price itself was seen as relatively inexpensive, and on the listing day the company went on to easily reach a market capitalization in the 2.8 trillion won range.

Aimed Bio develops antibody drug conjugate (ADC) therapies, a new drug modality that has recently drawn intense attention. The company has yet to clinically validate its technology in human subjects, but it is armed with a business track record of successfully licensing out every asset it has discovered.

The company was founded in 2018 by Professor Nam Do-hyun of Samsung Medical Center through a faculty start-up program. Leveraging Samsung Medical Center’s patient-derived cell and model (PDC, PDX) data, patient data and hospital-based research capabilities Aimed Bio has been identifying novel oncology targets and delivering first-in-class drugs with no prior equivalents.

It has licensed out AMB302 for bladder cancer to U.S.-based Biohaven and ODS025 for target-overexpressing solid tumors to Germany’s Boehringer Ingelheim. AMB303, aimed at ROR1-overexpressing solid tumors and co developed with SK Plasma is being prepared for an additional license-out deal.

While still unlisted, the company already achieved cumulative license-out performance totaling more than 3 trillion won.

With roughly 70 billion won raised through this IPO Aimed Bio plans to fund preclinical and clinical development of its flagship pipeline AMB303 nonclinical studies for follow-on pipelines (PP1, PP2, PP3), and the development of new platforms.

“Aimed Bio is, in my view, a biotech company with the strongest fundamentals and most validated track record ever to be introduced to general investors through an IPO.”

CEO Heo Nam goo said “We intend to set a new benchmark for Korea’s biotech industry.”

|

◇Inventage Lab Executives Rush to Gift Shares to Family, Signs of a Licensing Deal?

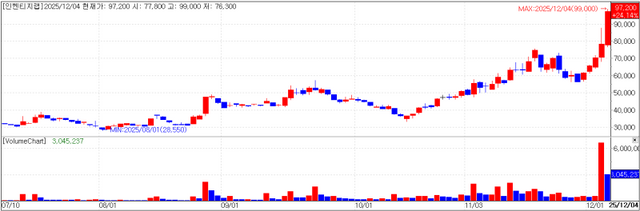

Inventage Lab closed at 97,200 won, up 24.14% (18,900 won) from the previous session. The move is seen as the combined result of the shareholder letter released a day earlier, the removal of the stock from the investment warning issue list, and news that company executives gifted shares to family members.

In a disclosure on the 2nd, Inventage Lab reported that CEO Kim Joo-hee, Head of Research Center Ryu Chung-ho, and Executive Director of Business Strategy Cha Joo-young had all gifted portions of their holdings to family members.

The market is drawing parallels to an episode earlier this year in February Lee Sang hoon CEO of ABL Bio Inc. gifted 10,000 shares to his child Lee Jin young and in May the company went on to sign a platform license out deal with UK-based GSK worth about 4 trillion won.

On that basis speculative buying is flowing into Inventage Lab on the view that a license out windfall could be on the way.

In a shareholder letter dated the 3rd, Inventage Lab also said it had completed GLP toxicology studies the first time in Korea for “IVL5005,” a long-acting, cannabidiol (CBD) based medical cannabis injectable that it is co-developing with Yuhan Health & Wellness and that it is in talks with overseas groups about clinical development.

The company added that it is preparing to seek orphan drug designation (ODD) for IVL5005 from the U.S. Food and Drug Administration (FDA). During discussions with the FDA, it received feedback that a long acting injectable with a duration of one month or longer may be inappropriate for pediatric patients and therefore decided to develop one week and two-week dosing formulations instead.

On the 3rd, Inventage Lab was also notified by the Korea Exchange that it had been removed from the list of investment warning issues.

The decision was based on the fact that, as of the closing price on December 2 2025 which marked the 10th trading day since the stock was designated an investment warning issue on November 19 2025 the stock price had not risen by 45% or more compared with five trading days before designation nor by 75% or more compared with 15 trading days before designation and that the closing price on the reference date was not the highest among the last 15 trading days.

The Korea Exchange noted that even after removal from the investment warning list, the stock may be re designated if the share price meets certain conditions within a short period. Specifically if on any assessment day within the 10 trading days from December 3 2025 the closing price is higher than both the closing price on the day before designation and the day before removal (70,500 won) and also at least 40% higher than the closing price two trading days earlier (65,600 won) or 91,840 won or above the stock will be immediately redesignated an investment warning issue on the following day.

If the conditions are not met on a given day, the assessment is rolled over by one day continuing through December 16 2025.

“Investor sentiment appears to have been stirred by the statement in our shareholder letter that we are pushing for orphan drug designation (ODD) for IVL5005.”

a company official said “We are working hard on license out opportunities but no one can predict when a deal will actually be signed.”

Copyright ⓒ 이데일리 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.