|

◇ HanAll Biopharma: only biotech name among Korea’s top 10 gainers

According to KG Zeroin’s MP Doctor platform (formerly MarketPoint) HanAll Biopharma was the only biotech related name to make it into the day’s top 10 gainers on the domestic market. Its share price jumped 18.59% from the previous session to close at 55,500 won. By contrast Peptron and Caregen, both of which released major disclosures after the close, saw their market values fall by double digits down 15.74% and 15.58%, respectively.

The session vividly highlighted a recurring pattern in the biotech sector share prices tend to diverge sharply depending on whether companies can deliver tangible results within the timelines they themselves have set. Because investors rely heavily on information disclosed by management credibility feeds directly into corporate valuations.

HanAll Biopharma’s rally reflected growing expectations that the company will keep its promise. A pivotal phase III readout is imminent for batoclimab one of HanAll Biopharma’s core pipeline assets and a candidate therapy for thyroid eye disease (TED). The data are expected as early as this month, or by next month at the latest. If approved market watchers project batoclimab could generate about 3 billion dollars in sales (roughly 4.4 trillion won) in the TED indication as a potential first in class treatment. Investors effectively bet on a successful phase III outcome during the session.

Not all views are upbeat however. In a report published on the 5th of last month titled “Current status of TED clinical development,” a Korea Investment & Securities analyst argued that batoclimab’s ongoing phase III trial is unlikely to generate sufficiently robust safety data to support a biologics license application.

According to that report, the dosing period in phase III has been extended relative to phase IIa. In phase IIa patients received weekly injections for two weeks; in phase III the regimen has been lengthened to weekly injections over 12 weeks. This design increases the odds of observing a reduction in proptosis at week 12, but it also raises safety concerns. By mechanism FcRn-blocking antibodies lower albumin levels as well as immunoglobulin G (IgG), and prolonged use may lead to adverse events such as edema or nutritional deficits. Batoclimab works by binding to the neonatal Fc receptor (FcRn) to block recycling of IgG antibodies. Because FcRn also protects albumin inhibiting it can drive down both proteins.

A HanAll Biopharma spokesperson countered that argument noting that in the phase III trial of batoclimab for myasthenia gravis (MG), the incidence of treatment emergent adverse events (TEAEs) requiring discontinuation was very low with no cases requiring dose reduction. The spokesperson added that similar patterns of albumin reduction have been observed with other drugs in the FcRn class that have already completed U.S. Food and Drug Administration (FDA) review and secured approval emphasizing that batoclimab’s safety profile remains within an acceptable range.

|

◇◇Peptron and Caregen: valuation reset looks unavoidable

Any decision on whether to continue riding HanAll Biopharma’s rally will likely be informed by what is happening at Peptron and Caregen. The two companies’ share prices fell sharply on the back of nothing more than news that disclosure of key results would be delayed.

On the 1st, Peptron announced that its platform technology evaluation agreement with global big pharma company Eli Lilly and Company had been extended to as late as October 7, 2026. The two companies originally signed the “platform technology evaluation agreement” on October 7 last year and began joint research applying Peptron’s SmartDepot long-acting injectable platform to Lilly’s peptide drugs. The non-exclusive license-type arrangement called for up to 14 months of joint research to evaluate the technology, followed by a potential definitive license agreement.

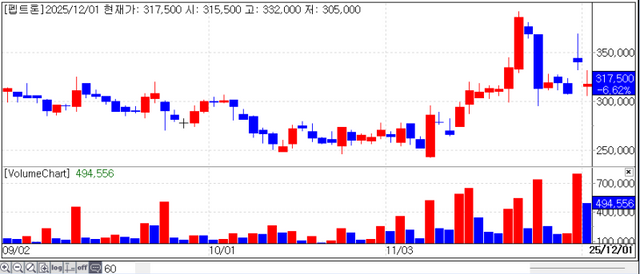

As with HanAll Biopharma, some in the market had already been voicing concerns that Peptron’s valuation had run too far ahead of fundamentals. While industry observers generally put the probability of a license-out deal above 50%, many viewed the risk as too high to justify fresh buying at stretched levels. Peptron’s share price had surged from around 50,000 won before the Lilly deal to nearly 400,000 won last month, making such concerns more than understandable.

The extension does not mean that the license-out opportunity has disappeared, but it does push out the potential decision point by about a year. As a result, a period of valuation adjustment for Peptron is widely expected.

A Peptron official said the company and Lilly agreed to conduct additional in vivo experiments on a SmartDepot formulation of a specific peptide, and that this was the reason for the new disclosure. The official stressed that, contrary to market concerns, joint research and technology evaluation between the companies are proceeding smoothly.

Caregen’s share-price drop also stemmed from concerns about credibility. The company is trying to position itself as an innovative drug developer, but has once again delayed the disclosure of clinical findings. Caregen had already pushed back the expected completion date of its phase I trial of CG-P5, a treatment for wet age related macular degeneration (wet AMD), three times, for a total delay of 11 months. On top of that, in a notice issued on the 26th of last month, the company pledged to disclose the trial results on the 1st.

Instead, Caregen released only selected metrics for the study in a press release on the day, without publishing the full clinical dataset through an official filing. For investors, that amounted to another broken promise. Until the company can repair the damage to its credibility, a sustained rebound in its valuation is seen as unlikely.

Caregen, for its part, maintains that the overall story remains intact. The company still plans to initiate a phase II trial of CG-P5 next year and to seek FDA Breakthrough Therapy designation for the candidate. To accelerate the program’s path to market Caregen has signed a strategic partnership with France-based contract development and manufacturing organization (CDMO) Unither Pharmaceuticals, which will support formulation and manufacturing. The company is also said to be in talks with multiple overseas pharmaceutical partners regarding a potential global license out of CG-P5.

“CG-P5 has the potential to become the world’s first potent topical therapy targeting VEGFR-2 and choroidal neovascularization (CNV)” Caregen CEO Chung Yong Jee said, adding that the company is preparing strategies to maximize efficacy in phase II.

Copyright ⓒ 이데일리 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.