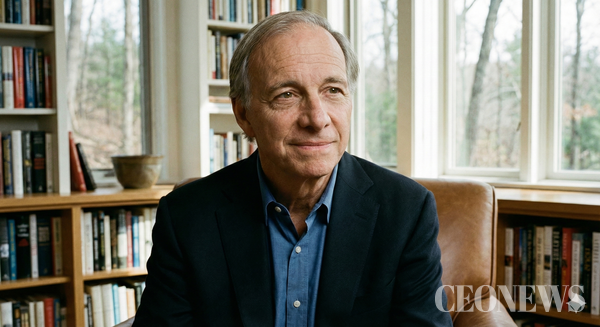

[CEONEWS=Jeon Young-seon] There is a figure whom the global financial market watches with bated breath. He is more than just an investor who makes money; he is the "Oracle of the Financial World" who reads the waves of history and penetrates the flow of capitalism. He is Ray Dalio, the founder of Bridgewater Associates.

For CEOs seeking a compass for management amidst the turbulent global economy and geopolitical crises of 2025, CEONEWS has selected Ray Dalio as this month's "Special Leader." His recent sharp analysis of the Donald Trump administration's policy direction goes beyond simple political commentary, offering deep insights into organizational management and leadership.

■ From a Small New York Apartment to the World's Largest Hedge Fund

Born in Queens, New York, in 1949 as the son of a jazz musician, Dalio bought his first stock at age 12 with money earned from caddying. It was Northeast Airlines. When the company was soon acquired, he tripled his investment, and from that moment on, he fell in love with the allure of the market.

After graduating from Harvard Business School and building his career on Wall Street, he founded Bridgewater in 1975 out of a two-bedroom apartment in Manhattan. Initially, it was merely a small consulting firm providing currency and interest rate risk advice to corporate clients. However, Dalio's exceptional market analysis capabilities and systematic investment principles grew Bridgewater into the world's largest hedge fund, managing approximately $150 billion (about 200 trillion KRW) in assets.

The journey was not always smooth. In 1982, Dalio predicted a Great Depression in the US economy triggered by the Mexican debt crisis, a prediction that missed the mark completely and drove him to the brink of bankruptcy. He had to fire all his employees and borrow money from his wife. Yet, this painful failure toughened him. "Admitting the fact that I could be wrong—that was the starting point of all success," he recalls.

■ The Power of Principles: Progress Through Pain and Reflection

When describing Ray Dalio, an indispensable keyword is "Principles." He systematized the wisdom gained through decades of investment experience and failure, making it the foundation of his organization's operations.

He emphasizes "Radical Truth" and "Radical Transparency." At Bridgewater, even an intern can ruthlessly criticize the CEO's logic if there are flaws. All meetings are recorded, and individual mistakes and weaknesses are shared openly. People encountering this culture for the first time are often shocked, but Dalio believes this is the key that enables organizational evolution.

The formula for life he proposes is clear: 'Pain + Reflection = Progress.' An organization busy hiding its failures can never evolve. Growth is only possible when painful failures are turned into data, analyzed coldly, and overcome through systems. This is a philosophy worth deeply inscribing for Korean CEOs facing an uncertain management environment.

■ Two Perspectives on the Trump 2.0 Era

Recently, Dalio raised a very interesting topic regarding the opening of the Trump administration. He assessed that President Trump, pushing for massive government reform alongside Elon Musk, has the potential to become a "Great Reformer."

Dalio expressed support for the direction of the "Department of Government Efficiency (DOGE)," which aims to dismantle bureaucracy and cut costs. This aligns with his long-emphasized concept of "eliminating organizational inefficiency." It is Dalio's theory that bloated bureaucracy, whether in a corporation or a nation, is the greatest enemy blocking innovation.

However, he did not stop at optimism. He simultaneously warned of the dangers of "inflation" and "internal conflict" that Trump's policies might bring. Protectionism and tariff policies may protect domestic industries in the short term, but in the long term, they could lead to rising prices and global trade wars. The "Trump 2.0" Dalio sees is a double-edged sword where the opportunity for "pro-business growth" and the crisis of "geopolitical division" coexist.

"Strong leadership eliminates inefficiency and promotes growth. But the key is how to manage the 'fire' that arises in the process." This statement by Dalio is an aphorism that leaders of all organizations today should take to heart.

■ The Big Cycle: Reading the Rise and Fall of Empires

In recent years, Dalio has shown aspects of a historian beyond just an investment strategist. In his book The Changing World Order, he analyzed the rise and fall of hegemonic nations like the Netherlands, the UK, and the US over the past 500 years, proposing the "Big Cycle" theory.

According to him, empires decline and a new order arrives when three signs appear: First, a rapid increase in debt; second, the intensification of internal conflict (wealth gaps and political polarization); and third, challenges from external forces (the rise of emerging powers).

The United States today is experiencing massive national debt and extreme political division. The reason Dalio is closely watching Trump's election is precisely from the perspective of this "cycle." Will strong leadership seal internal conflicts and increase efficiency to slow the decline, or will it amplify conflicts and hasten the collapse of the cycle? He constantly reminds us that we are standing at a turning point in history.

■ A Message to Korean CEOs

Ray Dalio is not a mere pessimist. He is a "realist" who faces reality coldly and prepares for it. The lessons he offers to CEONEWS readers are clear.

First, accept reality as it is. "Look at the world as it is, not as you wish it to be." Whether you like Trump's policies or not, you must coldly recognize the changed rules of the game and create response scenarios.

Second, build systems. Do not rely on individual intuition; create a decision-making system based on principles and algorithms. Only organizations that judge based on data, not emotions, survive crises.

Third, diversify and prepare. Diversify assets in preparation for the coming economic storm and secure cash flow for crisis situations.

■ Asking for the Way Amidst Chaos

Ray Dalio applauded Trump's "efficiency reforms" while warning of the "sparks of conflict" lurking beneath. This resonates with the sense of balance that managers must possess today. Driving innovation boldly while delicately managing the friction inside and outside the organization—that will be the qualification of a leader navigating the turbulent year of 2025.

Investor, philosopher, and eternal student, Ray Dalio. His journey—evolving from the brink of bankruptcy in 1982 to the founder of the world's largest hedge fund, and now to a thinker who reads the times—is itself living proof of the formula "Pain + Reflection = Progress." The questions he poses will serve as the most reliable lighthouse for us crossing this era of uncertainty.

Copyright ⓒ CEONEWS 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.