[CEONEWS = Reporter Lee Jae-hoon] In the spring of 2017, Amorepacific Chairman Suh Kyung-bae stood at the apex of South Korea's business world. He was the number one stock-rich individual, surpassing even Samsung Chairman Lee Kun-hee. Amorepacific's stock, trading at millions of Korean won (converted pre-split), reigned as the 'Emperor Stock.' Long queues formed in front of 'Sulwhasoo' counters in Chinese department stores, and the 'Cushion Compact' became the global beauty industry standard.

Just six years later, in 2023, Amorepacific's stock price plummeted to one-third of its peak. Its market share in China sharply dropped, and local indie brands surged domestically. The 'giant' Amorepacific, once the symbol of K-Beauty, faltered. Chairman Suh Kyung-bae made a massive, company-record investment of 935.1 billion won to acquire 'COSRX.' Is this a strategic move for a second founding, or a desperate struggle to delay the inevitable fall? This article dissects the leadership and strategy of Chairman Suh Kyung-bae—the history of South Korea's beauty industry itself—and the light and shadow he faces.

■ The Reclusive Artisan, 30 Years of Single-Minded DNA

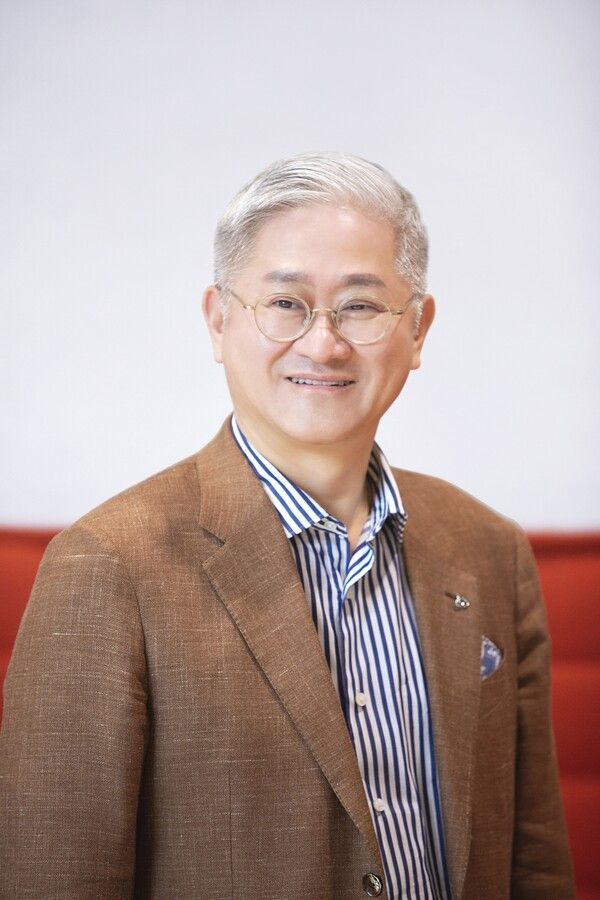

Born in 1963, Chairman Suh Kyung-bae is an elite executive who graduated from Yonsei University's Business Administration department and Cornell University's Graduate School of Management in the US. However, what defines him is not his academic background but his dedication to the 'field.' Since joining Taepyeongyang (now Amorepacific) in 1987, he has lived as a strict field-oriented manager.

The industry calls him the 'Pore Chairman.' He personally uses every new product, meticulously checking details like the size of cosmetic particles, skin absorption rate, and spreadability. A former executive recalled, "When presenting a product to the Chairman, we had to memorize all the data. He would ask about every single ingredient and particle size." This obsession with quality became Amorepacific's core competitive edge.

The division of the business—his older brother, Suh Young-bae, taking charge of construction and finance through Taepyeongyang Development, and Suh Kyung-bae inheriting cosmetics—is a well-known story in the business community. The brothers' division of labor was successful, and Suh Kyung-bae has walked the beauty path for nearly 30 years, transforming Amorepacific into a global enterprise.

■ The Counter-Intuitive Maverick, Turning Crisis into Opportunity

Chairman Suh's true value shone brightest during times of crisis. During the 1997 Asian Financial Crisis, when most companies focused on restructuring, he chose the opposite path: launching the premium herbal-medicine-based cosmetic 'Sulwhasoo.'

"Everyone said I was crazy. They asked who would buy high-end cosmetics when the economy was collapsing."

But Chairman Suh's judgment was correct. Sulwhasoo achieved massive success by pioneering a new category: 'luxury herbal cosmetics.' It became a coveted brand for women not just in Korea but across Greater China. His strategy of scientifically validating Hanbang (Korean traditional medicine) ingredients like ginseng and Jaumdang, and packaging them luxuriously, hit the mark.

In 2008, he initiated another revolution: the launch of 'IOPE Air Cushion.' This stamp-type foundation, rather than a tube or pump, changed global makeup trends. Global luxury brands like Yves Saint Laurent and Lancôme were forced to imitate Amore's cushion technology or pay royalties. It was the moment K-Beauty was recognized not just as a mere imitation but as a 'driver of innovation.'

■ The Zenith of the Golden Age, and the Fall

In the mid-2010s, Amorepacific entered its golden age. Fueled by the Hallyu (Korean Wave) boom in China, Amore brands—Sulwhasoo, Laneige, Innisfree—flew off the shelves. Chinese tourists queued up in front of Myeongdong roadside shops, and duty-free sales grew double digits annually. Chairman Suh Kyung-bae's assets exceeded 12 trillion won, and he surpassed Lee Kun-hee to become the number one stock-rich individual. Amorepacific's stock price broke through 400,000 won (pre-split). This was the 'Hwayangyeonhwa (the most beautiful moment in life)' for Suh Kyung-bae and Amorepacific.

However, this glory rested on a precarious balance. A significant portion of sales was concentrated in China and on Chinese tourists. Warnings about the 'China Risk' were constant, but in the face of the overwhelmingly sweet allure of the Chinese market, crisis management was relegated to the back burner.

■ THAAD Retaliation, and the Collapsed Fortress

In March 2017, China's retaliation began due to South Korea's deployment of the THAAD missile defense system: a ban on Hallyu content and a suspension of group tours. Amorepacific was hit directly. Chinese sales plummeted, and duty-free inventory piled up.

The bigger problem was the rise of Chinese local brands. C-Beauty brands like Perfect Diary (完美日记) and Huaxizi (花西子) aggressively captured the market with aggressive marketing and lower prices. The 'Guochao (国潮 - National Trend)' fever also led Chinese consumers to favor domestic brands. Arrogance—the belief that "it has to be Amore"—blinded the company to the changing market. Localization of the Chinese subsidiary was slow, and digital transformation was delayed. Amore was a step behind in a Chinese market where Wanghong (influencer) marketing and live commerce had become dominant.

■ Even the Domestic Market Is Shaken

To make matters worse, the domestic market also convulsed. H&B (Health & Beauty) stores, represented by CJ Olive Young, seized control of distribution. Inside them, derma cosmetics like Bioderma and La Roche-Posay, and indie brands like Torriden, Medyheal, and Dr.Jart+, grew rapidly.

The MZ generation no longer blindly trusted large corporate brands. They pursued 'smart consumption,' scrutinizing ingredients, efficacy, and value for money. They sought information on social media and YouTube, choosing products based on reviews.

Amorepacific's massive roadside shop-centric strategy (Innisfree, Etude) was outdated. Offline stores, burdened by high rent and labor costs, saw profitability worsen. Though store numbers were reduced, the company's grasp of online channels was delayed during that time.

■ The Shadow of Emperor Management

Some critics suggest that Chairman Suh Kyung-bae's powerful charisma has become a poison. A rigid organizational culture, formed by nearly 30 years of absolute power, and a decision-making structure that relies solely on the owner's intuition—where direct feedback from the working level fails to reach the top—is criticized for slowing down change.

An industry insider commented, "The Chairman is meticulous about individual products, but weak at reading overall market trends. Since the internal benchmark became 'Will the Chairman like this?', innovation was delayed."

The Blade of Counterattack, the 935.1 Billion Won COSRX Bet... The Biggest Wager Since Founding

Cornered, the card Chairman Suh Kyung-bae played in 2023 was a bold M&A. He acquired the remaining shares of the skincare brand 'COSRX' to incorporate it as a wholly-owned subsidiary. A total of 935.1 billion won was invested—the largest bet since the company's founding.

COSRX, a homegrown brand established in 2013, is famous for its acne and pore care products. Crucially, it has enjoyed explosive popularity in the North American market, becoming an 'Amazon Bestseller.' More than 90% of its sales come from overseas, primarily North America and Southeast Asia—the exact opposite structure of China-dependent Amorepacific.

This acquisition has two strategic implications:

De-Sinification (Decoupling from China): The clear intention is to offset lost sales in China with the North American market. COSRX has already secured a solid distribution network and brand awareness in North America. It's available in major channels like Amazon, Ulta Beauty, and Target, and is word-of-mouth popular among US consumers as a 'good-value K-Beauty.'

Implanting Digital DNA: COSRX is a digital-native brand that grew up primarily through online channels. It is strong in social media marketing, influencer collaboration, and data-driven product development—capabilities desperately needed by the offline-centric 'giant' Amore. Through this acquisition, Chairman Suh showed a shift away from the old 'Organic Growth' model to an aggressive investment strategy of acquiring successful companies.

■ AI and ESG, A Strategic Move for the Future

Chairman Suh Kyung-bae's counterattack is not limited to M&A. He is redefining Amorepacific not just as a cosmetics company but as a 'Beauty Tech company.'

AI customization is a prime example. 'Tone Work,' which won an Innovation Award at CES (Consumer Electronics Show), uses AI technology to analyze an individual's skin tone and instantly manufacture a perfectly matched foundation. 'Cosmechip' is an AI solution that diagnoses skin conditions and recommends customized products. These are the result of the Chairman's technological obsession, tailored for the hyper-personalization era.

ESG (Environmental, Social, and Governance) management is also being strengthened. Inheriting the founding philosophy of his father, Suh Sung-hwan—"the coexistence of nature and humanity"—he is pushing to reduce plastic use and expand refill stations. The goal is to reduce plastic use by 50% and increase the proportion of recycled materials to over 50% by 2030. This strategy meets global investment trends (ESG) while targeting the value-conscious MZ generation. Amorepacific's ESG rating is indeed among the top in the domestic cosmetics industry.

■ Authenticity or Survival Instinct?

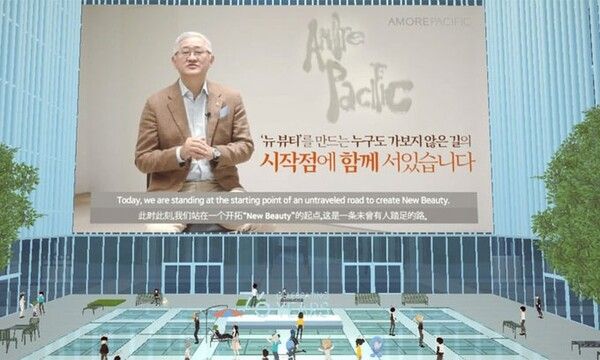

In a recent message to employees, Chairman Suh Kyung-bae emphasized the 'New Beauty' vision, stating, "Our mission is to make people beautiful and the world beautiful." The intent is to expand the definition of beauty beyond external appearance to health, well-being, and sustainability.

However, the market reaction remains reserved. While the COSRX acquisition succeeded in short-term performance defense, Amorepacific's revival is distant if the core brands, Sulwhasoo and Laneige, fail their rebranding efforts. The stock price has not yet shown a recovery trend. Investors are cautious, stating, "We need to observe for at least 2-3 years for the acquisition effect to materialize." Indeed, COSRX's 2024 performance fell short of expectations, hampered by intensified North American market competition and currency fluctuations.

The question I pose to Chairman Suh Kyung-bae is this: Can he completely abandon his lingering attachment to the past glory of the Chinese market? Can he disruptively innovate the massive organization to move like a nimble startup? And can he relinquish the absolute power he has held for nearly 30 years and delegate authority to younger talents?

What Chairman Suh Kyung-bae needs now is not the 'Leadership of Management' that meticulously takes care of details, but the 'Leadership of Innovation' that is willing to cut the fat and scrape the bone. Whether Amorepacific restores the pride of being the 'Big Brother of K-Beauty' or fades away like an old, forgotten tune depends solely on his decision. History only remembers the winners. Will Suh Kyung-bae, once the richest man in stocks, write a new myth, or will he be remembered as an emperor slow to change? Consumers and investors are cold-blooded. There is not much time left to wait.

Born in 1963

Graduated from Yonsei University (Business Administration) and Cornell University Graduate School of Management (USA)

1987: Joined Taepyeongyang (now Amorepacific)

1997: Appointed CEO and Vice Chairman

2003: Appointed CEO and Chairman

Key Achievements: Globalization of Sulwhasoo, development of the Cushion Compact, opening the first Asian beauty company store on New York's Fifth Avenue

Copyright ⓒ CEONEWS 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.