[CEONEWS=Lee Jae-hoon, CEO/Reporter] Koo Ja-eun (61), who became Chairman of LS Group in March 2022, is hitting the accelerator as he enters his third year of leadership. LS Group, which has traditionally pursued stable growth under its 'cousin-managed' system, is now attempting to transform into a future energy company centered on 'CFE (Carbon-Free Electricity)' under Chairman Koo's tenure. His strategy of expanding the portfolio into new businesses like battery materials, electric vehicle (EV) components, and semiconductor-related industries, rather than resting on the laurels of traditional sectors like cables and power equipment, is drawing attention from the business community. However, he also faces the significant challenge of delivering tangible results amid increased financial burdens from successive M&A deals and fierce market competition. We examine the management strategy and future challenges of Chairman Koo Ja-eun, who has transformed from the 'youngest cousin' to the 'CFE strategist.'

■ A 'Hands-on' Leader with 30 Years of Field Experience

Chairman Koo Ja-eun was born in 1964 and is the only son of the late Koo Doo-hwoi, Honorary Chairman of E1. In LS Group's unique 'cousin-managed' system, he is the youngest of the eight 'Ja'-generation cousins, and his management training was far from a glamorous 'crown prince' track. He joined LG-Caltex (now GS Caltex) as a regular employee in 1990, moved through LG Electronics, and after LS Group's separation, worked across key affiliates including LS Cable & System, LS Electric, and LS Mtron. His tenure as CEO of LS Mtron, where he led a turnaround by restructuring the business to focus on tractors and injection molding machines, is cited as proof of his practical management skills.

LS Group was established in 2003 when the cable and metal divisions spun off from LG Group. Spearheaded by the three brothers of LG founder Koo In-hwoi—Koo Tae-hwoi, Koo Pyung-hwoi, and Koo Doo-hwoi—the group adopted a unique governance structure where cousins take turns as chairman, rather than following primogeniture. The baton was passed from the first chairman, the late Koo Ja-hong and Koo Ja-yeol (former chairman), before reaching Koo Ja-eun. A business community insider commented, "LS's cousin management system provided Chairman Koo with an optimal training period, allowing him to gain experience across all of the group's businesses. He was a 'prepared leader' who had already grasped the group's strengths and weaknesses before taking the helm."

■ An Aggressive M&A Drive Under the 'CFE' Banner

The core vision presented by Chairman Koo is 'CFE (Carbon-Free Electricity).' With the goal of becoming a CFE-leading company with 50 trillion KRW in assets by 2030, he has embarked on aggressive M&A and investments since his inauguration. Key moves include establishing 'LS E-Link,' an EV charging infrastructure joint venture with E1 in 2022, and spinning off 'LS e-Mobility Solutions' the same year to strengthen its EV parts business (like relays). In 2023, 'LS Materials,' a subsidiary specializing in ultracapacitors (UC) as a next-gen energy storage device, was successfully listed (IPO), and he entered the battery material value chain by establishing a precursor joint venture with L&F, a cathode materials company.

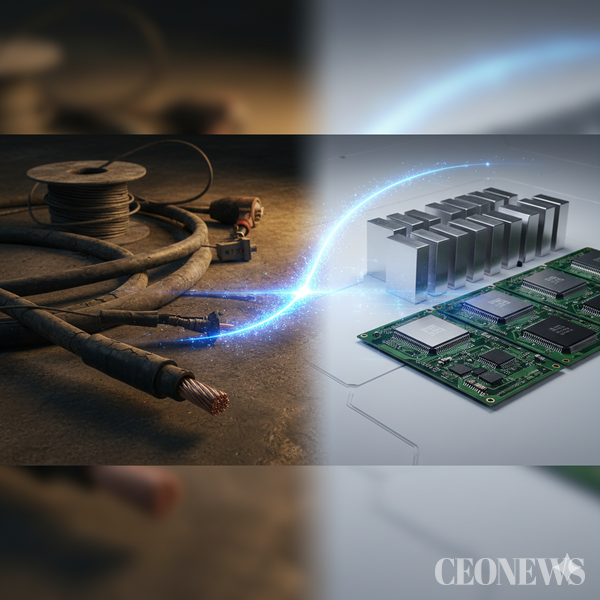

While emphasizing the importance of existing cable and power businesses by stating, "There is no AI or semiconductors without cables," Chairman Koo also clearly expressed a sense of crisis, saying, "The group's future cannot rest on cables alone." His 'BEC' (Battery, EV, Semiconductor) strategy is a plan to secure future growth engines based on the group's existing strength in power infrastructure. "Chairman Koo's M&A deals are seen as future investments that are fundamentally changing the group's constitution, as they are being executed with a clear direction," said a securities industry analyst. "However, the battery materials and EV charging markets are already red oceans where large corporations are fiercely competing, so it will likely take time to see tangible results."

■ Emphasizing 'Ambidextrous Management' and Digital Transformation

Chairman Koo's management philosophy is summarized as 'Ambidextrous Management.' This strategy involves managing the stable growth of existing core businesses—cables, power equipment, and copper smelting—with one hand, while pursuing aggressive expansion of new CFE-related businesses with the other. This is also linked to ESG management. Cables and power solutions for renewable energy (like offshore wind and solar) represent an ESG transformation of the existing business, while EV components and battery materials represent ESG realization through new businesses.

Furthermore, Chairman Koo is strongly promoting AI and Digital Transformation (DX). Representative examples include upgrading LS Electric's Cheongju smart factory, developing LS Mtron's autonomous tractors, and LS Cable's AI-based cable quality inspection system. At a recent strategy meeting, he stated, "In the age of AI, the power and communication solution capabilities that LS possesses will become even more important," and urged, "We must strengthen rapid decision-making and execution through agile management."

■ Financial Burdens and Market Competition: Hurdles to Overcome

However, there are also significant concerns about Chairman Koo's aggressive moves. The biggest issue is financial soundness. Due to the successive M&A deals, LS Group's debt-to-equity ratio remains high compared to competing groups, which is putting pressure on its credit rating. "Investment for growth is positive in itself, but if financial leverage becomes excessive while the timing and profitability of investment recovery are uncertain, liquidity risk could increase during a period of rising interest rates," a credit rating agency official pointed out.

Market competition is also fierce. The battery materials and EV charging infrastructure markets that LS has entered are already near saturation. It remains to be seen whether LS, a latecomer, can secure a meaningful market share in the battery market, which is already dominated by giants like Samsung SDI, LG Energy Solution, and SK On. An industry insider remarked, "Successfully integrating the acquired companies with existing businesses (PMI) and nurturing them into genuine 'second cash cows' will be the key measure of Chairman Koo's management ability."

■ 3rd Generation Succession: The Final Hurdle

Another critical task for Chairman Koo to overcome is the '3rd generation succession.' He is the last chairman from the 2nd generation's 'Ja' lineage. After his term, LS Group will fully enter the 3rd generation management era. Currently, 3rd generation members like Koo Bon-hyuk (CEO of Yesco Holdings) and Koo Dong-hwi (President of LS MnM) are at the forefront of management. Although LS Group has been cited as a model case for 'harmonious succession,' shareholding relationships and management control can always become a source of internal conflict.

A business expert commented, "Chairman Koo's term is a crucial period where he must achieve two goals simultaneously: establishing LS's future vision and ensuring a stable 3rd generation succession. If the CFE strategy leads to tangible results and the succession process proceeds smoothly, LS will be able to take another leap forward."

■ At the Crossroads of Stability and Innovation

From the 'youngest cousin' to the 'CFE strategist,' Chairman Koo Ja-eun, now marking his fourth anniversary as chairman, is making bold bets to transform LS Group from a 'stable cable powerhouse' into a 'dynamic future energy company.' His leadership in reorganizing the group's portfolio under the clear banner of CFE is breathing new vitality into LS. However, he also bears the heavy burden of solving three challenges simultaneously: the successful integration of M&As, securing financial soundness, and the 3rd generation succession. The business world's attention is focused on whether Koo Ja-eun's 'speed management' can successfully shed the familiar constraints of 'cables' and place LS Group on a new trajectory of 'future energy.'

* LS Cable & System: Power cables, communication cables manufacturing (Chairman Koo Ja-yeop)

* LS Electric: Power distribution panels, circuit breakers, etc. (President Koo Dong-hwi)

* LS Mtron: Tractors, injection molding machines, etc. (machinery business)

* LS MnM: Non-ferrous metals and secondary battery materials

* LS E-Link: EV charging infrastructure (JV with E1)

* Yesco Holdings: Holding company (CEO Koo Bon-hyuk)

Copyright ⓒ CEONEWS 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.