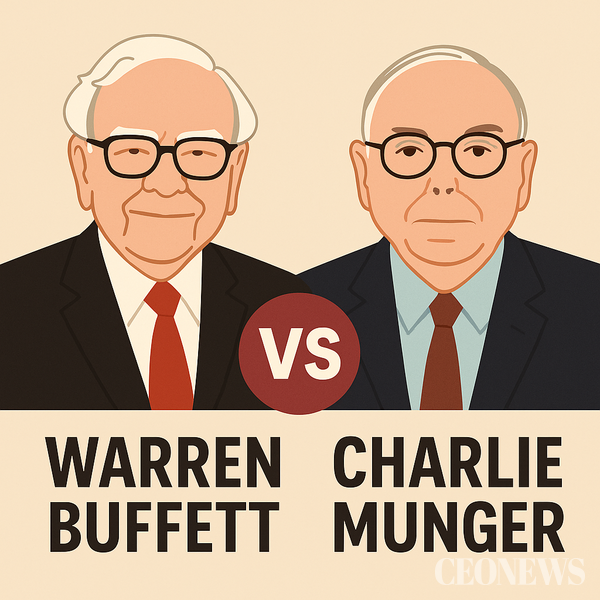

[CEONEWS = Lee Jae-hoon, Editor-in-Chief] “Great leadership is born not of solitude but of partnership.” For more than 60 years, Warren Buffett and Charlie Munger dominated the investing world. More than colleagues, the pair became a legendary combo that redefined value investing. In this CEO DNA Analyst special (Episode 9), CEONEWS dissects the similarities and differences of the most successful partnership in investment history.

■ Investment Philosophy: Same Roots, Different Branches

Buffett’s “Elegance of Simplicity”

Buffett’s philosophy can be summed up in one word: simplicity. “Don’t make it complicated” runs through every decision. He hews to Benjamin Graham’s value-investing principles and refuses to buy what he doesn’t understand. His portfolio is filled with household names—Coca-Cola, Apple, American Express. For Buffett, the best strategy is to “own a wonderful business forever.” He often says, “Our favorite holding period is forever,” refusing to be tossed about by short-term market noise—the hallmark of a true long-term investor.

Munger’s “Latticework of Mental Models”

Munger, by contrast, swears by a latticework of mental models. He integrates psychology, economics, physics, history—multiple disciplines—into investment judgments. “The most important thing is to master the big ideas from the big disciplines and use them on problems,” he argued, a philosophy that distinguishes him from Buffett. Munger emphasized “buying a good business at a fair price” and prized qualitative factors—brand power, management capability, durable competitive advantage. Crucially, his approach nudged Buffett beyond simple “cheapness” toward a quality-centric style.

■ Decision-Making Style: Intuition vs. Logic

Buffett’s “Lightning-Fast Judgement”

Buffett can decide with startling speed. It’s been said his 2016 decision to invest in Apple took mere hours. Numbers matter, but he prioritizes grasping the essence of a business. His process is lightning: evaluate competitiveness, management caliber, and future growth in one integrated look—then act. This swift decisiveness is a core reason he is called the Oracle of Omaha.

Munger’s “Systematic First-Principles Thinking”

Munger is the mirror opposite. He deconstructs problems from first principles and studies for months, testing a decision from many angles. His shelves hold thousands of books, and that accumulated knowledge shows up in every call. “I don’t invest until I have arguments that cannot be refuted,” he said. The caution can cost opportunities—but it prevents catastrophic mistakes.

■ Leadership Style: Charisma vs. Mentoring

Buffett’s “Popular Charisma”

Buffett is a born communicator. Berkshire Hathaway’s annual meeting—dubbed the “Woodstock of Capitalism”—draws over 40,000 investors worldwide. He can render complex ideas with metaphors about hamburgers and baseball. His leadership rests on transparency: he admits errors and shares both wins and losses candidly. That authenticity made him the “Sage of Omaha.”

Munger’s “Intellectual Mentorship”

Munger wasn’t a showy speaker, but his depth captivated audiences. He loved a Socratic Q&A, guiding others to find answers themselves. Even Buffett admitted, “Charlie freed me from Graham’s narrow focus.” Munger’s leadership is rooted in intellectual humility: he starts from “I could be wrong,” and keeps learning.

■ Performance and Market Impact

Berkshire Hathaway’s Miraculous Compounding

Together they delivered the extraordinary. From 1965 to 2023, Berkshire Hathaway compounded at 19.8% annually, versus 10.5% for the S&P 500. A $1,000 investment in Berkshire in 1965 would be about $37 million by 2023; the same in the S&P 500 would be roughly $240,000—over a 150x difference.

A Global Mindset Shift

Their influence far exceeded returns. They popularized “value investing” and changed how investors think. Today’s dominant themes—ESG, long-term holding, corporate governance—trace back, in spirit, to their philosophy.

■ Shared DNA: The Secrets of Success

Lifelong Learners

– Buffett reportedly reads 500 pages a day; Munger was called a “walking library.”

– Even in their 90s, they chased new technologies and trends.

Healthy Attitude Toward Failure

– They admit mistakes and mine them for lessons.

– They share the view: “The person who never makes a mistake never does anything.”

Long-Term Orientation

– They ignore quarterly noise and think in decades.

– “Time is the friend of the wonderful business, the enemy of the mediocre one.”

Principles First

– They resist fads and hold to their own rules.

– They value reputation and trust above money.

■ 2023: The End of an Era

On November 28, 2023, Charlie Munger passed away at age 99, drawing to a close a partnership of more than six decades. Buffett mourned: “There would be no Berkshire Hathaway of today without Charlie.” In one of his final interviews, Munger said, “The secret of a great partnership is recognizing each other’s strengths and offsetting weaknesses.” It perfectly distills the essence of their 60-year collaboration.

■ The Legacy of a Great Partnership

Buffett and Munger are a masterclass in how different DNAs can create synergy. Buffett’s intuition and charisma fused with Munger’s logic and wisdom to forge the most successful investment partnership in history. Their story transcends techniques; it teaches what real partnership means in life and business. When people with different perspectives aim at a shared goal and work in concert, the outcome can be monumental—a living textbook.

Lessons for Us

The Power of Diversity: Collaboration across different backgrounds and mindsets breeds innovation.

A Long Horizon: Don’t chase short-term results; create value with a durable, long view.

Humble Learning: Keep a learner’s posture regardless of age or success.

The Strength of Principles: In the face of temptations and pressure, holding fast to your principles is true leadership.

The DNA of Buffett and Munger still runs through Wall Street and the veins of investors worldwide. Their legacy in value investing will remain a North Star for generations. Giants depart—but their philosophy and spirit endure. These two legends proved it.

Copyright ⓒ CEONEWS 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.