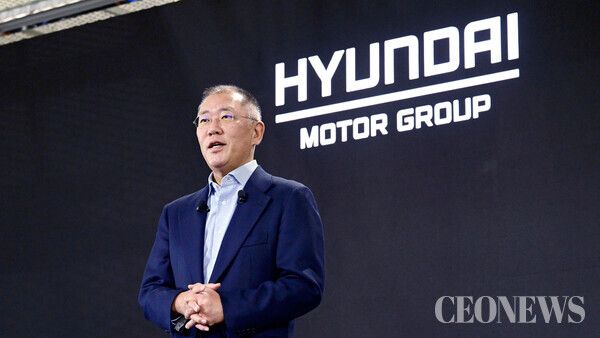

[CEONEWS = Jaehoon Lee, Editor-in-Chief] “He is not merely a crown prince.” That is how Korea Inc. now describes Euisun Chung, Executive Chair of Hyundai Motor Group. The grandson of founder Ju-yung Chung and only son of Honorary Chairman Mong-ku Chung certainly inherited formidable pedigree. Yet today’s Euisun stands beyond bloodline—a reformer intent on rewiring Hyundai’s DNA and architecting a global mobility empire. This X-File dissects his personal life, legal battles, M&A moves, succession calculus, and future vision to examine his ambition and risk—side by side.

Born a Crown Prince, Forged as an Innovator

Born October 18, 1970, he seemed destined for Hyundai from day one. But he did not walk the typical path of a pampered third-generation chaebol heir. After graduating Kyungbock High School and earning a B.A. in Business Administration at Korea University, he completed an MBA at the University of San Francisco. Joining Hyundai, he rotated through sales, planning, and procurement, cultivating a field-driven leadership style. From childhood, he absorbed the essence of management through rigorous “dinner-table instruction” from his grandfather and father. He sensed that a fossil-fuel-centric Hyundai could not secure the future—intuition that later fueled bold bets like acquiring Boston Dynamics and co-founding Motional. Within four years of taking the helm, he lifted Hyundai Motor Group into the global top three automakers and delivered record operating profits at Hyundai and Kia—results now dubbed “The Euisun Way.” Two decades after being dismissed as a “cheap brand,” Hyundai gained recognition in Europe and the U.S., underpinned by his high-performance “N” brand strategy.

He did not lean on lineage alone. From Executive Vice President in 2009 to Executive Vice Chairman in 2018 and Executive Chair in 2020, he proved himself at each rung. Genesis crystallized his luxury ambition, going toe-to-toe with BMW and Mercedes-Benz, while the IONIQ lineup made Hyundai a credible EV peer to Tesla. These outcomes reflect his blend of shop-floor experience and global sensibility—redefining what Hyundai stands for.

Marriage and Bloodline—A Strategic Puzzle Beyond Family

His 1995 marriage to Jung Ji-sun, eldest daughter of SAMPYO Group Chairman Jung Do-won, was at once personal and, to some, a strategic alliance in Korea Inc. Friends since youth, the couple’s relationship is widely seen as a genuine romance rather than an arranged union; nonetheless, inter-group ties added stability to the Euisun regime. Known for her artistic sensibility and poise, Jung has quietly supported the Chairman’s global public role, aiding Hyundai’s brand elevation. They have three children—two daughters, Jin-hee and Yoo-hee, and a son, Jae-shin—whose future roles remain unknown but closely watched. In June 2022, their eldest married at Jeongdong First Methodist Church in Seoul, to a nephew of the late Daewoo Group Chairman Kim Woo-choong—a symbolic moment in fourth-generation chaebol matrimony that drew top business figures including Samsung’s Jay Y. Lee and broadcaster Noh Hyun-jung, underscoring Hyundai’s network.

Jung is a discreet yet potent presence at global Hyundai events, indirectly supporting culture and arts sponsorships that strengthen Hyundai’s soft power. Projects like “Hyundai Motorstudio” are often seen as aligned with her artistic touch. The children’s eventual roles could be decisive variables in succession. While observers speculate that son Jae-shin may one day enter management, Euisun has not revealed a formal succession plan—another sign of his cautious approach.

Lawfare and M&A—The Gambit of a Risk-Taker

His path to control was not smooth. Controversies over related-party transactions at Hyundai Glovis triggered scrutiny by the Korea Fair Trade Commission (KFTC) and hundreds of billions of won in fines—clouds over his ascent. Euisun countered by selling portions of his Glovis stake and simplifying the group’s circular ownership links—turning legal risk into an opportunity to streamline governance.

On the M&A front, he played offense. In 2020 he established Motional, a joint venture with U.S. autonomous-driving specialist Aptiv, and later increased Hyundai’s stake to accelerate commercialization. Motional is developing Level-4 autonomy using the IONIQ 5 platform and launched a pilot service in Las Vegas in 2024. Still, gaps with Waymo and Cruise and uncertainties over commercialization timelines remain challenges.

In 2021 he stunned markets by acquiring Boston Dynamics for roughly $880 million—more than a robotics deal, it was a declaration that Hyundai would evolve into a “future mobility solutions company.” The four-legged robot Spot and humanoid Atlas are being trial-deployed in Hyundai’s smart factories and logistics. At Hyundai’s Ulsan plant, Spot has been used for line inspections, boosting efficiency. Yet Boston Dynamics’ persistent losses and IPO uncertainty are risk factors. During a 2021 U.S. trip, Euisun personally inspected Motional and Boston Dynamics to tighten collaboration—signaling conviction in his roadmap.

Succession and Inheritance—Equations Yet to Solve

His throne looks secure but the game is not over. First, he must finish dismantling circular shareholdings. The Hyundai Mobis-centric web still draws transparency criticism. After a 2018 Mobis–Glovis split-merge was shelved due to shareholder pushback, he has pursued incremental simplification. Second, inheritance tax looms: liabilities tied to stakes inherited from Honorary Chairman Mong-ku Chung are estimated around ₩2.6 trillion—large enough to affect group finances.

Finally, next-generation succession. Markets watch the children closely. Today, Euisun reportedly owns about 0.32% of Hyundai Mobis, 2.67% of Hyundai Motor, and 1.78% of Kia. To consolidate control, additional capital will be needed. Analysts expect IPOs of Boston Dynamics and Motional could fund taxes; for instance, if Boston Dynamics went public in 2026, it could raise on the order of ₩5 trillion, by some estimates. In parallel, he is seen expanding dividends and using cross-holdings as financing levers while advancing a Mobis-centered simplification—an interlocking strategy where succession finance meets future-tech investment.

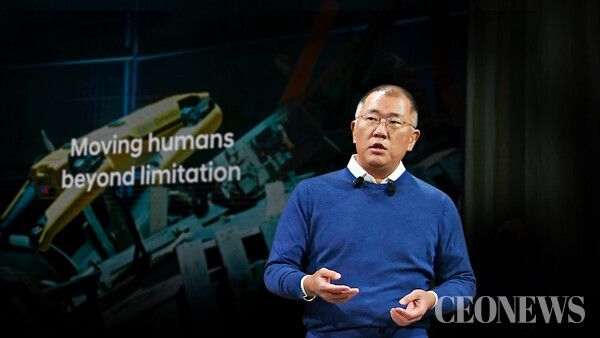

A Wide-Open March Toward the Future

Euisun defines Hyundai not as a “car maker” but as a “smart mobility solutions company,” focusing on four pillars. First, electrification: Hyundai targets 2 million annual EV sales by 2030, expanding the IONIQ and Genesis EV lineups. As of 2024, IONIQ 5 and 6 have sold over 300,000 units globally, competing with Tesla’s Model 3. The NEXO fuel-cell SUV offers up to 720 km of range, proving everyday utility. Second, autonomy: through Motional, Hyundai is developing Level-4 systems and scaling tests toward a 2025 commercialization target. Third, robotics: leveraging Boston Dynamics to expand manufacturing, logistics, and humanoid applications, with an eye to commercializing Atlas and producing 200 units by 2028. Lastly, UAM (urban air mobility): Supernal is developing an eVTOL aircraft, targeting entry into service in 2028. Its blueprint connects UAM with PBVs (purpose-built vehicles) and mobility hubs to reimagine urban flow. Long-term, Hyundai aims to extend fuel-cell systems to UAM, ships, and aircraft by 2040. This is not diversification for its own sake; it is a wholesale rebuild of Hyundai’s corporate DNA.

Outlook—Light and Shadow

His success formula: crisis navigation, aggressive investment, and calibrated succession. He acknowledges Elon Musk as a pioneer in automotive disruption—even as Hyundai, which ranked No. 2 globally in EVs in 2024, still faces gaps versus Tesla and BYD. To counter BYD’s price offensive and Tesla’s tech edge, he is pushing India as a growth beachhead, expanding the Chennai complex toward 1 million units of annual capacity and developing locally tuned EVs.

But shadows persist. Boston Dynamics’ roughly ₩300 billion annual losses and Motional’s commercialization delays weigh on finances. Global macro softness, intensifying EV competition, and data-exposure risks tied to “MyData”-style policies are headwinds. Inheritance tax and governance reform add complexity. Euisun wears two faces at once: visionary reformer and third-generation owner. His leadership has elevated Hyundai into a global mobility contender, but sustainable profitability and durable technological edge will decide the verdict.

From Crown Prince to Empire Architect

Euisun Chung is no longer just another chaebol scion. He is a reformer steering Hyundai toward the future—and an architect of a smart mobility empire, with plans to extend fuel-cell applications to aircraft and ships. By lifting brand equity through Genesis and IONIQ, front-running future tech via Motional and Boston Dynamics, and opening the skies with Supernal, he has pushed Hyundai beyond the confines of a traditional automaker. Yet massive inheritance taxes, governance overhaul, and global competition are the waves ahead. The question is singular: Will he remain a mere successor—or become the true creator of a global mobility empire? The world now watches Euisun Chung’s next move.

Copyright ⓒ CEONEWS 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.