![박수남 CEONEWS 데스크/부사장 KOREA CEO NEWS [Park Soo-nam's E.S.GISM] Kyochon Chicken Decline and Resurrection, What is the Game Changer?](https://images-cdn.newspic.kr/detail_image/521/2024/12/19/13e47e79-31e4-42f7-a715-fecd28168268.jpg?area=BODY&requestKey=w3Hru72p)

[CEONEWS= Reporter Park Soo-nam] IBK Investment & Securities predicted on the 12th that "the highest performance ever next year" for Kyochon F&B. KB Securities and Eugene Investment & Securities also made similar forecasts through interviews and reports, respectively. In the third quarter, Kyochon recorded its highest sales in seven quarters. Nam Sung-hyun, a researcher at IBK Investment & Securities, said in an interview with a media outlet that there will be no need to have doubts about profit growth considering the effect of switching to the affiliated regional headquarters and additional momentum.

Kyochon Chicken Decline and Resurrection, What is the Game Changer?

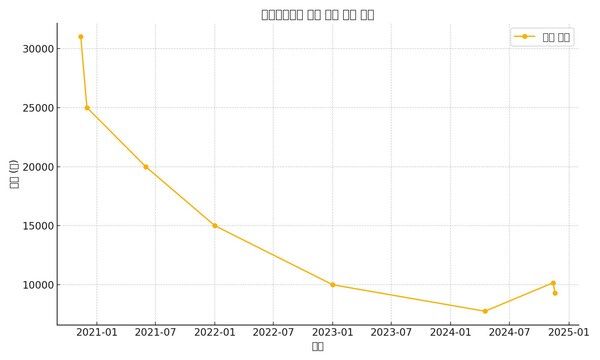

On April 16, 2021, Hanwha Investment & Securities published a report, predicting an increase in the stock price of Kyochon F&B. Nam Sung-hyun, a former researcher at Hanwha Investment & Securities, said the possibility of Kyochon F&B's re-rating is increasing. Nam is currently a researcher at IBK Investment & Securities, and is an analyst who previously predicted Kyochon's highest performance next year. As a result, Kyochon's stock price continued to fall from April 1, 2021 to April 16, 2024. Contrary to the outlook, the stock price fell by about 14,240 won per share during the period, with the decline rate reaching 64.7%.

Thanks for reading KOREA’s Substack! Subscribe for free to receive new posts and support my work.

Three years later, Nam Seong-hyun, a researcher at IBK Investment & Securities Co., released his pink outlook on Kyochon F&B again on Oct. 22, 2024. Various media and stock markets have also joined the pink pen shower. No one knows whether the index will go backwards or forwards like in 2021.

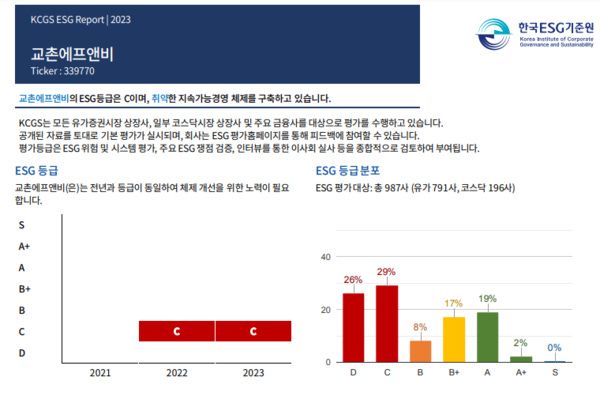

Then, is there any point that the stock market and the media overlooks in predicting the future of Kyochon? There is one thing. It is Kyochon's ESG management performance. The relationship between ESG and stock index has been proven through empirical research and extensive statistics at leading research institutes at home and abroad. In conclusion, the objective evaluation of ESG management in Kyochon is negative.

Kyochon Chicken Decline and Resurrection, What is the Game Changer?

A bigger problem than the current negative state is the future outlook. Kyochon's overall ESG rating in 2024 is D grade. In particular, as a result of the 2024 evaluation, both environmental (E), social (S), and governance (G) fell compared to 2022 and 2023. The definition of D grade lowered by the Korea ESG Standards Institute is as follows.

The content is quite serious to dismiss as a definition of an institution's evaluation grade standard. As previously pointed out, the ESG rating and the stock index are inextricably linked. Regardless of next year's performance, Kyochon must solve the challenges of ESG management. The question remains whether the problem was properly recognized in that the new strategies of Kyochon, which were put forward by Chairman Kwon Won-gang, who returned to the management front in 2022 when he returned to the management line due to a management crisis, were "

Of course, eco-friendly materials, various sponsorships, and coexistence with franchisees were advocated in 2024, but the objective evaluation was 'worsening'. In terms of deterioration, not maintaining the status quo, it seems that the Kyochon government needs an overall rebuilding of ESG management.

Kyochon has long been No. 1 in the chicken franchise industry since it continued to grow with the stubbornness of its founder, Kwon Won-gang. Now that the championship belt has been taken away, what is needed is change rather than growth. And what makes that change possible is the leader's will to change. The chart's evaluation of Chairman Kwon's strategy, which he had brought out when he returned in 2022, is over. It is up to Chairman Kwon how to interpret it, accept it, and what chart he will draw in the future. Chairman Kwon's actions are drawing attention.

Copyright ⓒ CEONEWS 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.