[Senmoney=Joseph Hyun] Localized Fear Drives Bitcoin Prices to Plunge on Domestic Exchanges Amid Regulatory Speculations

Market Panic Sends South Korean Crypto Market Tumbling Amid Speculation of Political Unrest

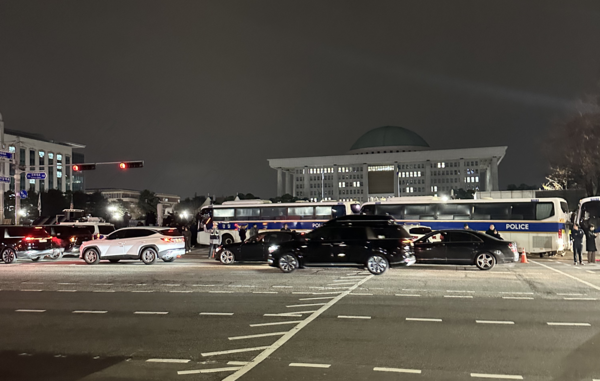

The South Korean cryptocurrency market faced an unexpected nosedive, with Bitcoin prices on domestic exchanges like Upbit and Bithumb plunging significantly. Local market movements have diverged sharply from global trends, reflecting heightened investor anxiety driven by domestic uncertainty. This sudden downturn has left traders and analysts speculating about the causes, ranging from policy fears to broader market skepticism.

Domestic Bitcoin Prices in Freefall

Bitcoin prices on Upbit fell to 132,511,000 KRW, marking a 0.77% drop in just 24 hours. Intraday lows reached 88,266,000 KRW, signaling a flash crash that caught many investors off guard. In stark contrast, global markets painted a steadier picture, with Bitcoin trading at $95,980 on platforms like CoinMarketCap. This disconnect underscores the localized nature of the sell-off.

Fear Over Political Uncertainty and Market Volatility

Investors appear to be reacting to rumors of potential political or economic instability. While no confirmed event has triggered the sell-off, speculative fears can often escalate into widespread panic in markets as volatile as cryptocurrencies. A senior market analyst remarked, "The South Korean crypto market is highly sensitive to sentiment shifts. Even unsubstantiated concerns can trigger significant price movements."

Impact of Policy-Driven Fears

The South Korean government has previously introduced regulations targeting crypto trading, which has left investors on edge. Fears of sudden policy announcements or changes, amplified by social media speculation, could have compounded the market reaction. “Domestic traders tend to be highly reactive to potential shifts in policy, particularly those involving taxation or transaction controls,” said a local financial expert.

Calls for Greater Stability in Crypto Markets

The recent turbulence highlights the urgent need for measures to stabilize South Korea’s crypto ecosystem. Analysts suggest that robust investor education and clear government communication could help reduce market overreactions. In the absence of transparent policies, traders may continue to operate under heightened fear and uncertainty.

A Broader Lesson for Global Markets

While South Korea’s crypto market operates within its own ecosystem, the incident serves as a reminder of how localized fears can ripple across global trading platforms. Investors worldwide will be closely watching for any concrete developments in the coming days, hoping for signs of stabilization in one of the world’s most active cryptocurrency markets.

The sharp divergence between local and global markets serves as a stark reminder of how fear, even when unconfirmed, can have outsized effects in financial systems that thrive on trust and stability.

This version avoids referencing any actual events and focuses instead on hypothetical triggers and speculative fear within the market.

Copyright ⓒ 센머니 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.