[CEONEWS=Lee Jae-hoon, Editor-in-Chief] There is a figure who keeps shifting the tectonic plates of Korea’s corporate landscape: SK Group Chairman Chey Tae-won (64). Unlike the younger chiefs—Samsung’s Lee Jae-yong, LG’s Koo Kwang-mo, and Hyundai Motor’s Chung Euisun—Chey has walked a markedly different path. He is often cast as a disruptive innovator who transcends the bounds of conventional corporate management. Yet behind that image lie a painful family history, a complex succession puzzle, and a high-profile divorce that has persistently buffeted his life. His story is both a microcosm of SK’s 60-plus-year history and a mirror reflecting the light and shadows of the Korean chaebol system. Will Chey swing open SK’s future as a true disruptor—or continue as a solitary high-stakes player fighting alone? Here is his X-File.

■A Twisted Family Tree and the Trap of Succession

Chey was born the eldest son of the late Chairman Chey Jong-hyun, SK’s second leader and younger brother of founder Chey Jong-gun. What looks simple on paper conceals SK’s unusually intricate succession architecture. Founded in 1953 as Sunkyong Textile, the group’s course changed in 1973 when founder Chey Jong-gun died suddenly and his brother—rather than a direct heir—took the helm. It was an early break with the chaebol norm of strict primogeniture. Over the next three decades, Chey Jong-hyun grew SK into Korea’s No. 3 business group. Within this unique backdrop, Chey Tae-won naturally found himself on the path to becoming the third-generation successor. A physics graduate of Yonsei University with a Ph.D. in economics from the University of Chicago, he joined SK in 1991, rotating through SK Telecom and SK Energy to prepare for succession in a methodical way.

■Emergency Succession in the Asian Financial Crisis

Fate came faster—and harsher—than expected. When his father died in 1998, Chey, then 38, had to assume the group’s leadership in the middle of Korea’s IMF crisis. SK was staring down heavy debt and acute liquidity stress. Chey’s immediate answer was “selection and concentration”—selling non-core assets, deleveraging, and imposing tough, survival-first reforms.

“At the time, there was no choice,” he later recalled. “It was about saving the group—or watching it collapse.”

He navigated the storm and emerged with a reputation as a crisis-management maestro.

■“Cooperative Governance” with His Brothers

In recent years, Chey’s siblings have drawn more notice. Younger brother Chey Jae-won, Senior Vice Chairman, oversees SK Innovation and SK On, steering batteries and green businesses; cousin Chey Chang-won, Vice Chairman of SK Discovery, leads bio and investment lines. The model is less one-man rule and more distributed leadership based on capability and role. Analysts argue SK has evolved beyond primogeniture toward decentralized governance, with broader empowerment of professional managers—a reflection of Chey’s management creed.

■The Shadow Called “Divorce”

The most charged issue surrounding Chey is his divorce case with Roh So-young, head of Art Center Nabi—an affair that spills well beyond privacy into massive asset division and the group’s control structure. The controversy dates to 2015, when Chey publicly acknowledged a child from an extramarital relationship. Roh filed for divorce in 2017; the legal battle has raged for eight years. The stakes are enormous: with Chey’s wealth heavily tied to SK affiliates, a large court-ordered division could reshape control over the group.

■Opinion Split: Candor vs. Morality

Public sentiment is sharply divided. Supporters see “honest leadership,” noting that Chey did not bury inconvenient truths. Critics counter that, unlike his widely respected late father, Chey has incurred the label of a “family-abandoning tycoon.” In a Realmeter poll last year, 52% of respondents said a corporate owner’s morality affects corporate image—underscoring how his private life reverberates across SK’s reputation.

What It Means for Control

Beyond image, the governance impact could be profound. A sizable asset division could dilute Chey’s stakes and weaken control over core affiliates like SK Telecom and SK Innovation, potentially constraining group-level strategy. As one financial regulator put it, changes in a controlling shareholder’s equity directly influence governance and strategy—especially in a chaebol context.

■The “Deep Change” Gambler—Remaking the Portfolio with M&A

Chey’s disruptor status rests on audacious M&A bets that rewired SK’s portfolio. The emblematic case is the 2012 acquisition of Hynix for about ₩3.6 trillion. Panned then as reckless—given memory cyclicality and cost—the move proved a masterstroke. Renamed SK hynix, the company vaulted to No. 2 globally in memory, riding AI and data-center demand to a valuation north of ₩100 trillion.

“Everyone opposed it,” Chey recalls. “But semiconductors were the core of the future.”

A Daring AI Pivot

Chey’s latest “Deep Change” thrust is the AI transformation of SK Telecom. He has pushed a merger with SK Broadband, poured capital into AI data centers and AI semiconductors, and framed SKT as a full-fledged AI company. Bulls see a saturated telco market and welcome a new growth engine where network infrastructure meets AI. Skeptics warn of early-stage monetization risks, bruising competition with global Big Tech, and long gestation periods before returns match the capex.

■ESG as Competitive Doctrine

Chey is also an early champion of ESG. In 2021 he declared ESG “a survival imperative, not just corporate responsibility.” SK has pledged to cut 2 million tons of emissions by 2030 and to achieve net-zero by 2050. The group mapped ₩18 trillion for the hydrogen ecosystem and is expanding renewables. SK On, spun out of SK Innovation, has risen to Top-3 status in EV batteries, building plants across the U.S., Europe, and China. Still, critics point to greenwashing risks and thin near-term returns despite massive investment—fueling shareholder unease.

■Vision: “Separate Yet Together”

Chey’s future blueprint hinges on “separate yet together.” Each affiliate operates autonomously while the group orchestrates capital allocation and strategic direction. In an era where speed is survival, he argues, centralized decision-making can’t keep up. The result: sharper specialization at the affiliate level and faster calls where it counts.

■SK’s Tomorrow, Driven by AI

For Chey, AI is SK’s future—and its survival strategy. Anchored by SK Telecom, he aims to infuse AI across the portfolio: AI chips, AI healthcare, AI logistics, and beyond. SKT’s large language model “A.”, tailored for Korean, is touted as a differentiator for building a twin-track B2B/B2C platform. Yet success is hardly guaranteed against OpenAI, Google, and Microsoft—incumbents already defining the AI frontier.

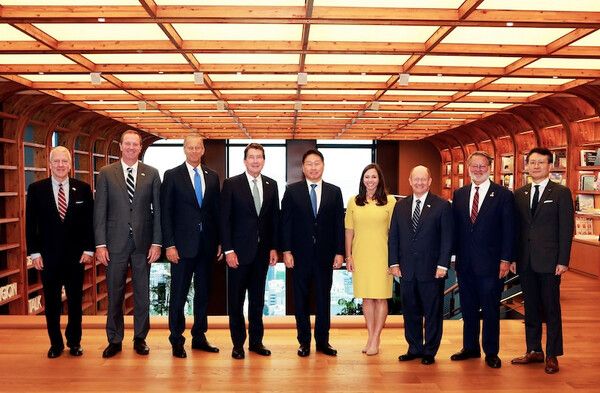

■Global Expansion—and Its Frictions

Chey wants SK to be unmistakably global. SK hynix now shares a duopoly-like standing with Samsung in memory; SK On is planting flags across major EV hubs; SK has announced large investments in U.S. AI startups while widening its Southeast Asian and European footprint. But global expansion invites regulatory pitfalls, cultural friction, and fierce incumbents. Above all, intensifying U.S.–China tech rivalry keeps shifting the ground under semiconductors and AI—demanding agile, strategic counter-moves.

■Outlook: Korea Inc.’s Human Compass

Looking back on 25 years at the helm, Chey unmistakably shows the marks of a disruptive innovator: crisis rescue, the Hynix bet, and now an AI re-architecture. Yet the long shadow of his divorce remains—the source of loneliness, controversy, and potential governance instability. Even so, he moves forward: prepping for the AI age, preaching ESG as doctrine, and grinding for global competitiveness. This is the portrait of a leader who has outgrown the label of a mere second-generation heir to become a true entrepreneur.

Will he overcome the personal and business headwinds to vault SK into the global pantheon—or falter under the weight of private wounds and strategic risk? Chey Tae-won’s next moves will serve as a compass for Korea Inc. The story is far from over. Between “disruptive innovator” and “lonely gambler,” what will be his final gambit? All eyes are on the man poised to script SK’s next 100 years.

Copyright ⓒ CEONEWS 무단 전재 및 재배포 금지

본 콘텐츠는 뉴스픽 파트너스에서 공유된 콘텐츠입니다.